The Earthquake’s Impact on Remittances

The earthquake in Haiti has exacerbated an existing distress during the international recession and increased uncertainty of what to do and how to help.

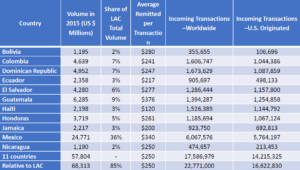

Remittances play an instrumental role in improving the lives of remittance receivers as increases in disposable income can be turned into increases in formalized savings, simultaneously facilitating financial access and inclusion. Many households in Central American, the Caribbean, and South America rely on remittances as the main source of income. In fact, nearly 23 million households received USD$16.6 million in remittances in 2015 from the United States.

[caption id="attachment_63245" align="alignnone" width="300"] Source: https://www.thedialogue.org/resources/remittance-transfers-scoredcard-2016-test/[/caption]

Source: https://www.thedialogue.org/resources/remittance-transfers-scoredcard-2016-test/[/caption]

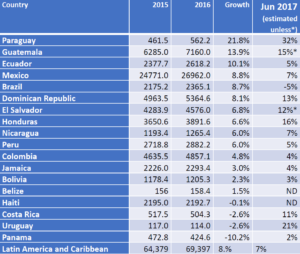

In 2016, remittances from the United States to Latin America and the Caribbean grew 8%; and it is estimated that remittances will have a 7% increase in 2017.

[caption id="attachment_63248" align="alignnone" width="300"] Source: https://www.thedialogue.org/resources/remittances-to-latin-america-and-the-caribbean-in-2016 and estimates for 2017 using the same methodology[/caption]

Source: https://www.thedialogue.org/resources/remittances-to-latin-america-and-the-caribbean-in-2016 and estimates for 2017 using the same methodology[/caption]

This growth can be explained by four trends in relation to the remittances, migration, and technology/innovation.

In regards to point 3, there has been a significant increase in electronic/internet based transfers since 2010. In 2010, 7% of survey participants said they would change their method of sending money through internet-based transfers and 4% said mobile phone transfers. In 2016 those percentages increased to 21% and 22%, respectively.1

Internet and mobile transfers constitute an innovation for the remittance industry as these types of transfers can be more convenient, lower transaction costs, and provide faster services. While internet-based transfers have increased - due in part to robust payment networks, variety of money transfer services, access to technology, and technological innovations - the cross-border market remains incipient.

Only 6% of remittance senders in Latin America and the Caribbean use some form of internet-based transfers.2 While competitiveness has driven the development of the FinTech (Financial Technology) market including affordable pricing, effectiveness, and a fair regulatory environment, the low usage rate of internet and mobile based transfers requires further analysis. Cross-border mobile and internet remittances among Latin American and Caribbean migrants are particularly low as users need to own proper technology, own a bank account, and download an app. However, internet and mobile transfers represent an underutilized but valuable tool in promoting financial inclusion and access.

The maximization of the remittances happens at two levels inside the financial environment:

To promote financial access and financial inclusion, several financial institutions have sought to further innovation by combining products and services, expanding payment networks, or strengthening relationships with remittance recipients via financial education tools. The development of the FinTech sector has united remittances, technology, and innovation to promote financial inclusion, therefore, according to Dr. Manuel Orozco, the challenge is not to improve the technology since it is there but to expand usage among existing and new consumers.

The earthquake in Haiti has exacerbated an existing distress during the international recession and increased uncertainty of what to do and how to help.

The US State Department is fostering new methods of engaging directly with Latin American citizens.

Throughout Latin America, a digital divide has emerged.

Monito / Flickr / CC BY 2.0

Monito / Flickr / CC BY 2.0