Is a Global Growth Slowdown Threatening Latin America?

What effects will downbeat economic sentiment have on Latin American countries? Which ones are most at risk?

A Daily Publication of The Dialogue

A rising level of inflation “is no longer a risk but a tangible reality in a number of emerging markets,” including the main economies of Latin America, Alberto Ramos, the head of Latin America economic research at Goldman Sachs, said in a note on April 13. Inflation “will likely get worse before it gets better,” he added. What are the major factors putting pressure on inflation in Latin America? How much do rising consumer prices in the region threaten economic recovery from the Covid-19 pandemic-led recession? Which countries of the region will see the highest levels of inflation this year, and how much room do their central banks have to raise interest rates and take other corrective action?

Alfredo Coutiño, director for Latin America at Moody’s Analytics: “Inflation is a serious risk in Latin America for the short and longer terms as it could threaten the region’s economic recovery. The upward inflation trend is caused not only by transitory factors but also has a monetary root. A common component in the region’s rising inflation is rising commodity prices, particularly prices of energy and food, which constitutes an imported inflation. A second set of components comes from domestic factors; on the one hand, there are still some supply shortages and disruptions caused by the virus outbreak and resurgence, which are more of a transitory nature. On the other hand, inflation has a monetary root caused by the prolonged money expansion that central banks have implemented. The region’s monetary stance is either expansionary or ultra-expansionary, as evidenced by the significant excess liquidity still circulating in economies. In most countries, the real quantity of money is still growing at a speed much superior than that of the quantity of goods and services produced. This root is more a longer-lasting event as the economic recovery is still weak and heavily relies on the support of the monetary crutch. Moreover, given the single anti-inflationary monetary mandate, the inflation persistence could force central banks to start tightening monetary conditions sooner rather than later, thus limiting the strength of the recovery. Inflation is out of the target’s upper range in Brazil and Mexico, and above the central target in Peru, while it shows an increasing trend in Chile. All these countries still persist in the use of monetary stimulus to support the economy, even though growth is not part of their respective mandates. Given the inflation risk, policymakers face the challenge of starting to normalize monetary conditions soon. Unfortunately, central banks have become victims of their own single monetary mandate."

Daniel M. Schydlowsky, visiting professor at the Hebrew University of Jerusalem and former Peruvian superintendent of banking, insurance and private pension fund administrators: “In the context of the pandemic, measuring inflation is a daunting task. What consumption basket is relevant when some 20-30 percent of the normal expenditures are prohibited? And should services such as delivery of groceries become part of the product’s recorded cost, or should they become part of the decimated service-sector percentage of the price index? And how should housing services be assessed when moving is severely curtailed? Reaching for the underlying determinants of inflation can perhaps provide a more useful guide for price developments during and after the pandemic. If an inflationary spiral already exists, it is likely to continue, depending on its strength. Regarding the aggregate supply-demand balance, with a government-induced recession, there can be no generalized excess demand, hence no demand-pull inflation. Indeed, there will be excess supply of products, such as food, resulting from the shutdown of tourism, restaurants and the entertainment industry. These prices are likely to fall. With gross government interventions, there will inevitably be ‘local’ imbalances. These will be aggravated by supply-line disruptions coming from abroad, many of them from China. Hence there is likely to be imported inflation for selected products. Where there are insufficient international reserves and exports fall, devaluation may ensue and initiate or continue an inflationary spiral. The fraction of normal expenditure now not allowed (20- 30 percent of the total) may find its way partially into other expenditures (for example, computers to be used at home, televisions and home improvement products) and force prices up in these sectors of the economy. Normally, government subsidies raise aggregate demand; under Covid-19 conditions, they only partially replace lost income. As Covid-19 dissipates, forced savings will decline along with government subsidies. However, some net increase in precautionary savings will remain. In summary, there is little reason to think that Covid-19 has generated or exacerbated inflation, or that its aftermath will do so. Indeed, existing measures of inflation need to be examined carefully for their suitability to the current conditions.”

Allison Fedirka, director of analysis at Geopolitical Futures: “Inflation risks and levels vary widely across Latin America. The fear of inflation in the region is driven by how quickly it can get out of control and persist in an economy. Current inflation concerns center around Mexico and Brazil, the region’s two largest economies and ones where inflation has been under control in recent years. Central banks in the region have a variety of tools they can use to address the problem, including raising interest rates. Bear in mind, however, that while Latin American economists largely follow U.S. economic school of thought, their economies face fundamentally different realities, and therefore corrective actions will not necessarily follow standard, U.S. prescription. Inflation becomes particularly problematic in the region when it affects energy and food prices, which is applicable to the current situation. Inflation presents a greater threat post-pandemic as larger portions of the region’s population are more vulnerable to price increases. Unemployment has increased, many people have fallen back into poverty, and informal labor has gained ground. None of these countries can count on domestic consumer demand for recovery, nor was it ever really a viable option beforehand. Instead, these countries must look to external sources of economic activity, such as trade and investment. A weaker economy coupled with inflation does, however, present a large threat to any semblance of political stability in a given country. People will demand the government meet their needs, and many governments will be hard pressed to respond effectively.”

Gary Hufbauer, senior fellow at the Peterson Institute for International Economics: “The most startling feature about the inflation experience in Latin America is its diversity. At one end of the scale, Venezuelan President Nicolás Maduro has engulfed Venezuela in hyperinflation—more than 2,000 percent per year. At the other end, Caribbean islands linked to the U.S. dollar experience practically zero inflation. In between, Argentina’s inflation is way too high, around 40 percent, while Chile’s inflation is less than 3 percent. Mexico is around 5 percent, and Brazil around 6 percent. The pandemic has struck all of Latin America. Modest national differences in infection and death rates cannot explain wide differences in inflation rates. Nor are distinct commodity cycles responsible for the diverse inflation experience. The explanation, as Milton Friedman would have said, lies in political control of central banks. Those beholden to national leaders are often forced—as in Venezuela, Suriname, Argentina and Haiti—to print money to finance large budget deficits. It is Modern Monetary Theory with a vengeance. Independent central banks, and those tied to the U.S. dollar, are considerably more prudent. Strong recovery during the second half of 2021—in the United States, a few other advanced countries, along with China and much of Asia—will put upward pressure on global prices, especially for services and goods in short supply (for example, semiconductors). These forces will bring marginally higher inflation to Latin America. But the big inflation story for the region will in fact be a series of separate stories, each determined by national policies.”

Alicia Girón, professor at the Economic Research Institute of the National Autonomous University of Mexico: “Many financial organizations have seen inflation as an enemy to defeat. It is enough just to recall Brazil’s and Argentina’s experiences with inflation in the 1980s. In recent years, inflation targets and central bank reforms that prioritized curbing inflation over economic growth have mitigated inflation. Today’s health, economic and financial crisis has shown that contractionary monetary policies have failed. Monetary austerity has restricted public spending on health, education and even access to water as shown by recent data from the spring meeting of the International Monetary Fund. Most important for Latin America is the creation of employment for a speedy recovery, prioritizing fiscal policy, increasing public spending to trigger the reactivation of the private sector and forgetting about inflation. Does Latin America want stable macroeconomic indicators promoting austerity and restricting public spending, or sustained and sustainable economic development with jobs and inflation? Not having inflation means not spending and therefore restricting employment. In that case, Latin American governments will hardly be able to achieve the U.N. Sustainable Development Goals.”

The Latin America Advisor features Q&A from leaders in politics, economics, and finance every business day. It is available to members of the Dialogue’s Corporate Program and others by subscription.

The Latin America Advisor features Q&A from leaders in politics, economics, and finance every business day. It is available to members of the Dialogue’s Corporate Program and others by subscription.

What effects will downbeat economic sentiment have on Latin American countries? Which ones are most at risk?

Although migrants have experienced a modest improvement since the recession, one in three remain in a “vulnerable” financial position.

What are the main challenges US banks must overcome in order to do business in Cuba?

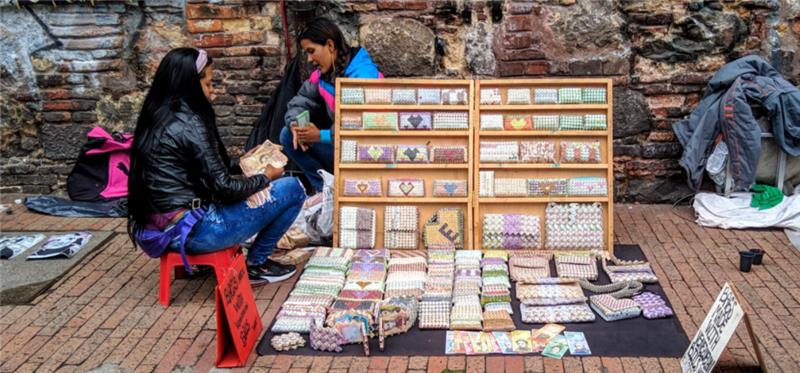

Latin American countries may be facing serious inflation risks. Venezuelan refugees in Bogotá

are pictured selling crafts made of virtually worthless Venezuelan currency. // Photo: Reg

Natarajan via Creative Commons.

Latin American countries may be facing serious inflation risks. Venezuelan refugees in Bogotá

are pictured selling crafts made of virtually worthless Venezuelan currency. // Photo: Reg

Natarajan via Creative Commons.