China, India & Colombia’s Interbolsa

Colombian firm Interbolsa is being liquidated in a move to protect the interests of Colombia’s financial markets.

In June, Nicaragua’s Congress approved a concession for the construction of a new transoceanic canal that will be financed by Chinese businessman Wang Jing and his firm, HKND. The project has been heavily scrutinized, both as a source of competition for the Panama Canal and as an example of China’s expanding economic influence (more analysis of the arrangement here). This and other Chinese bids call into question Taiwan’s long-standing political relationships in the Central America.

Central America is one of Taiwan’s only remaining diplomatic strongholds. Six of the twenty-one nations that currently recognize Taipei (Belize, El Salvador, Guatemala, Honduras, Nicaragua and Panama) are located in the region. While Taiwan’s government has cultivated these important ties through generous economic assistance and frequent high-level visits, China’s meteoric rise and growing economic clout have made diplomatic partnership with the Chinese mainland more tempting than ever. Costa Rica made a historic break with Taipei in 2007, while commercial and investment opportunities have slowly drawn other Central American countries into mainland China’s orbit.

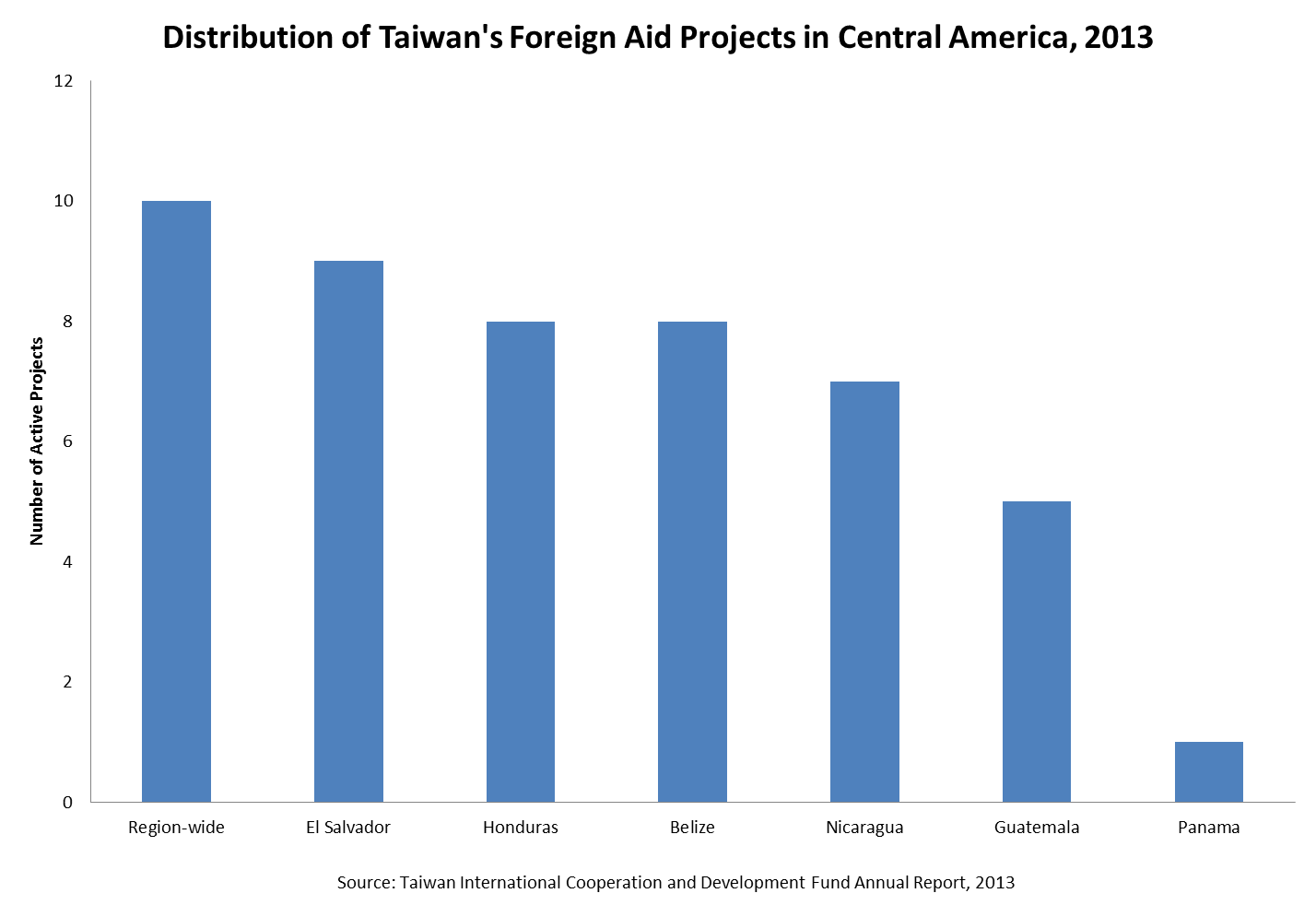

Taipei has traditionally curried favor with Central American government through generous foreign assistance and economic cooperation. Over the past decade, Taipei inked free trade agreements with the governments of Guatemala, Honduras, El Salvador, Nicaragua and Panama. Taiwan’s International Cooperation and Development Fund (ICDF) registered a total of 48 active projects across the isthmus in 2013, with ICDF approving more than 120 million dollars in new loans for the region-wide social development, education and technological training in the coming years.

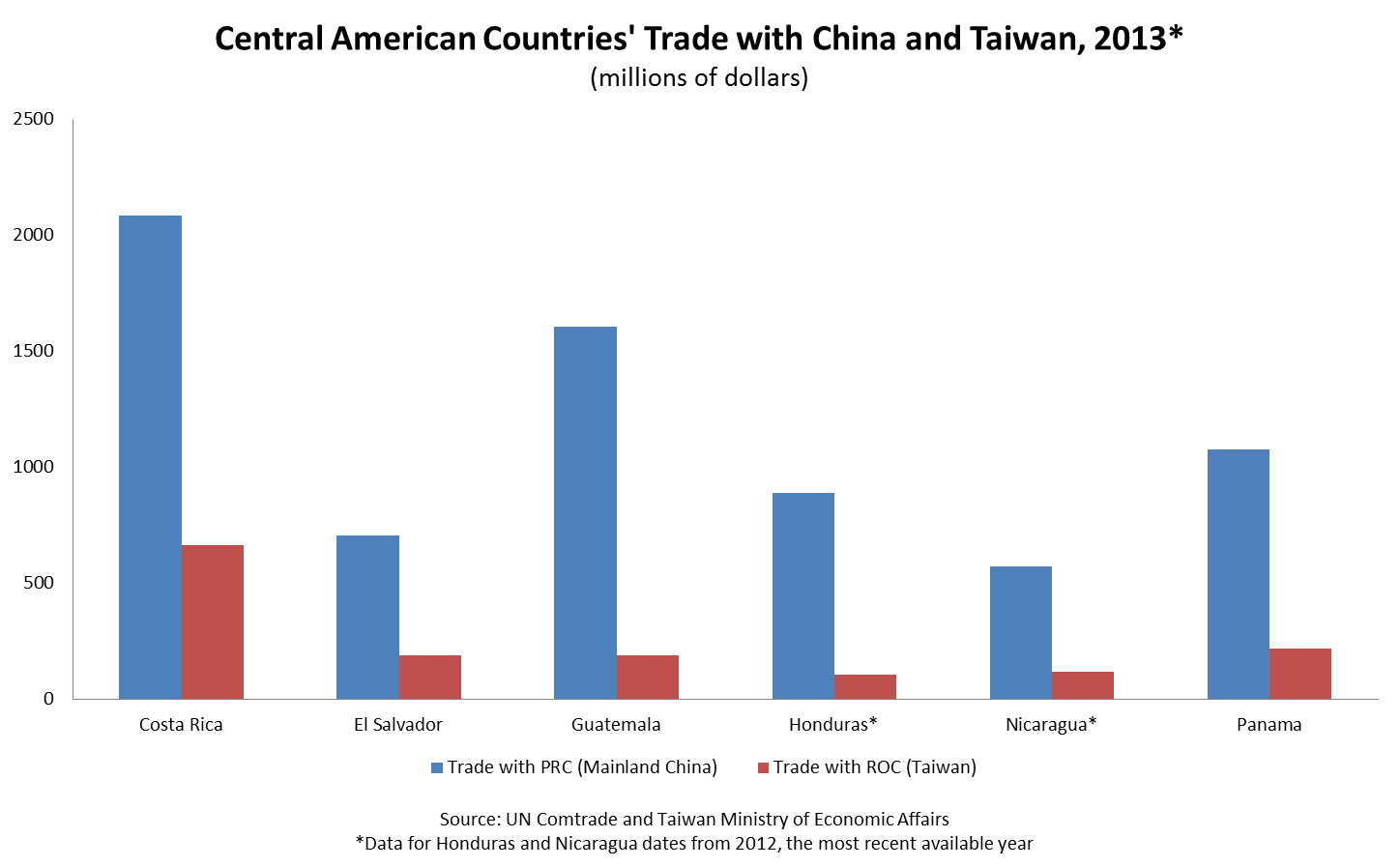

But Taiwan’s economic clout in the region is increasingly overshadowed by a rapidly growing China. Mainland China’s trade with the isthmus has outpaced that of its diplomatic rival in recent years, bolstered in part by booming demand for Central American natural resources. Guatemala’s trade with mainland China grew a whopping nine time faster than did its commerce with Taiwan over the past decade, despite ratifying a free trade agreement with the ROC in 2005. Disparities are even greater in nearby Honduras and Panama. Primary commodities — including wood from Nicaragua and El Salvador, copper from Panama, precious metals from Honduras, and sugar from Guatemala — make up the bulk of Central America’s exports to China. Central America’s imports of Chinese products have expanded even more rapidly than the region’s exports. Nicaragua increased its consumption of Chinese goods from 150 million in 2005 to 562 million in 2012, while Guatemala, El Salvador, and Honduras experienced similar increases.

Chinese firms are also increasingly interested in investment opportunities in Central America. China’s Ministry of Finance estimates that the stock of Chinese foreign direct investment in Panama alone increased nearly tenfold between 2005 and 2011. As plans for the Nicaragua Canal move ahead, Wang Jing’s Xinwei Telecom is working to establish the groundwork for telephone and internet services, bringing $100 million USD worth of equipment to Nicaragua in 2014.

The energy and infrastructure sectors have attracted most Chinese investments in the region. China Machine New Energy Corporation has undertaken the construction of electricity generation facilities in Guatemala and Honduras, while China’s Sinohydro Corporation has neared completion of a new hydroelectric dam on Honduras’ Patuca River. China Harbour Engineering Company expressed interest in Honduras’ Palmerola Airport bidding process in 2013, though ultimately choose not to participate. The firm also reportedly gained government approval to conduct a feasibility study on a cross-country railroad in 2013.

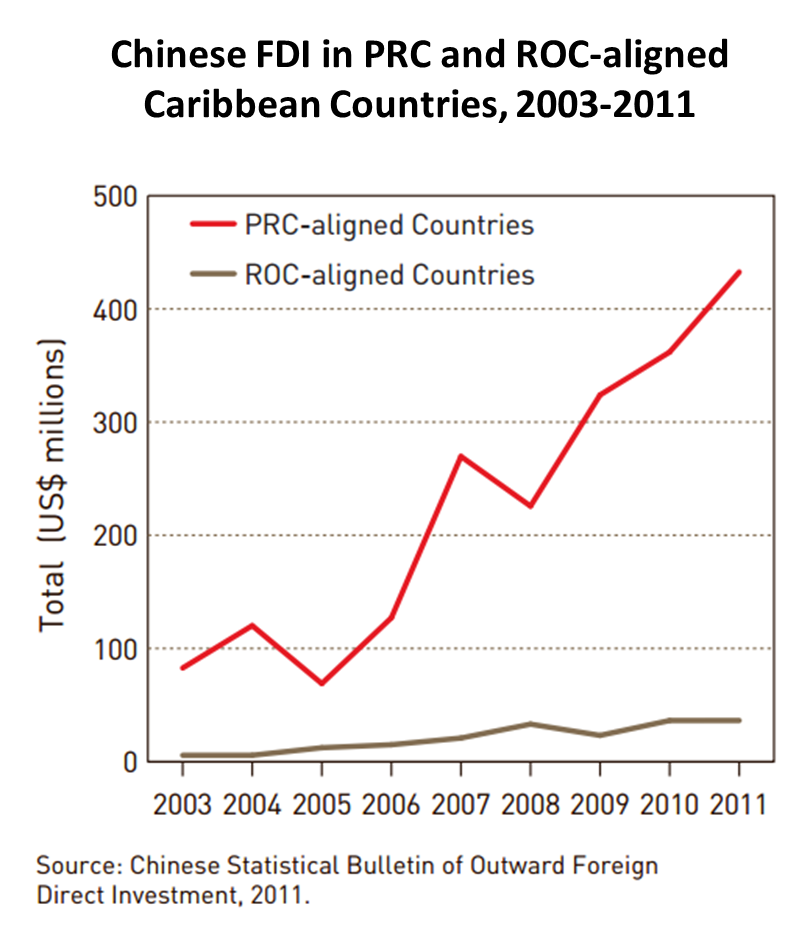

Still, investment and financing from mainland China remain largely confined to its diplomatic partners. Firms in allied countries may benefit from government assistance in brokering investment deals, as well as greater backing from Chinese financial institutions. A 2013 report published by the Inter-American Dialogue, for example, shows that Chinese FDI for the PRC’s allies in the Caribbean exceeded 400 million dollars in 2011, more than nine times the level of investment in in Taiwan affiliates. As China’s global footprint continues to expand, the country’s markets and abundant capital are increasingly enticing.

Still, investment and financing from mainland China remain largely confined to its diplomatic partners. Firms in allied countries may benefit from government assistance in brokering investment deals, as well as greater backing from Chinese financial institutions. A 2013 report published by the Inter-American Dialogue, for example, shows that Chinese FDI for the PRC’s allies in the Caribbean exceeded 400 million dollars in 2011, more than nine times the level of investment in in Taiwan affiliates. As China’s global footprint continues to expand, the country’s markets and abundant capital are increasingly enticing.

Costa Rica terminated official ties with Taiwan and diplomatically recognized the PRC in June 2007. Then-president Oscar Arias acknowledged his move as “an act of foreign policy realism which promotes our links to Asia.” “It is my responsibility,” he added, “to recognize a global player as important as the People’s Republic of China.”

New deals quickly materialized following the switch. Beijing purchased approximately 300 million dollars in Costa Rican government bonds, and devoted 90 million dollars to constructing a new sports stadium in the country. The China-Costa Rica Free Trade Agreement reduced duties on 90 percent of products, establishing preferential prices for Costa Rican agricultural goods in Chinese markets. San José was also one of a handful of capitals visited by Chinese President Xi Jinping on his 2013 tour of Latin America. During his visit, the head of state pledged nearly 500 million dollars in financing for transportation and infrastructure projects.

Several aspects of Costa Rica’s new partnership with China have proved contentious, however. Local groups objected to the use of Chinese laborers and equipment in the construction of Costa Rica’s new stadium. Beijing’s image has been further tarnished by allegations of corruption involving a 1.5 billion deal to expand the country’s Moín oil refinery, a project by led by China National Petroleum Corporation (CNPC) and financed by China Development Bank (CDB).

Costa Rica’s diplomatic about-face has prompted speculation that similar announcements could be forthcoming from its Central American neighbors. Former presidents of El Salvador and Honduras announced their openness to establishing relations with mainland China in 2010 and 2012, respectively. Honduras’ current government has yet to appoint an ambassador to Taiwan after more than 12 months – a move that could signal further distancing by new Honduran president, Juan Orlando Hernández.

Most governments in the region have nonetheless made economic overtures to Beijing. El Salvador opened a trade office in China in 2013 and the Guatemalan Minister of Economy traveled to China to visited free trade zones in Shanghai in order to evaluate the possibility of similar zones in Guatemala. In 2014, the Panama and the PRC agreed to create free trade processing zones in Panama, allowing products “manufactured, processed, assembled or finished” in these areas to enter China under special conditions, in order to promote high export volumes and promote “the integration in international value chains.”

But Central American countries also have strong motivations to preserve their relations with Taipei. Taiwan remains a major provider of aid to the region. Recent allegations suggest, however, that at least some of these funds have lined the pockets of the region’s political elite. In March 2014, Guatemala’s former president Alfonso Portillo of Guatemala admitted to accepting 2.5 million dollars in kickbacks from Taipei in exchange for sustaining friendly policies between the two countries. Former president Francisco Flores of El Salvador has been similarly accused of laundering more than 5 million in Taiwanese aid during the early 2000’s. In 2012, Panamanian president Ricardo Martinelli refused to acknowledge the diplomatic credentials of Taipei’s ambassador for six months after the envoy met with an opposition leader. Following the resolution of the controversy, Taiwan made a generous donation of aid to assist Panamanian disaster relief efforts. Central American heads of state also face internal opposition to greater relations with China from local industry leaders, which fear greater competition from cheaply manufactured Chinese goods.

Can Central America have it both ways? While diplomatic rivalry between Taipei and Beijing continues to simmer, a slow détente between Taiwan and mainland China could create greater middle ground for Central American countries in the coming years. As it stands, governments allied to Taiwan are pursing enhanced commercial relations with China while still maintaining their political allegiance to Taipei.

Colombian firm Interbolsa is being liquidated in a move to protect the interests of Colombia’s financial markets.

What is the state of Peru-China commercial ties today?

Venezuelan president Nicolas Maduro left China last month with a supposed show of support from the Chinese government.