Shale Gas in Latin America

Unless resource nationalism can be made compatible with providing incentives for significant foreign participation, it may be too early to start trumpeting a bonanza for Latin America.

This post is also available in: Español

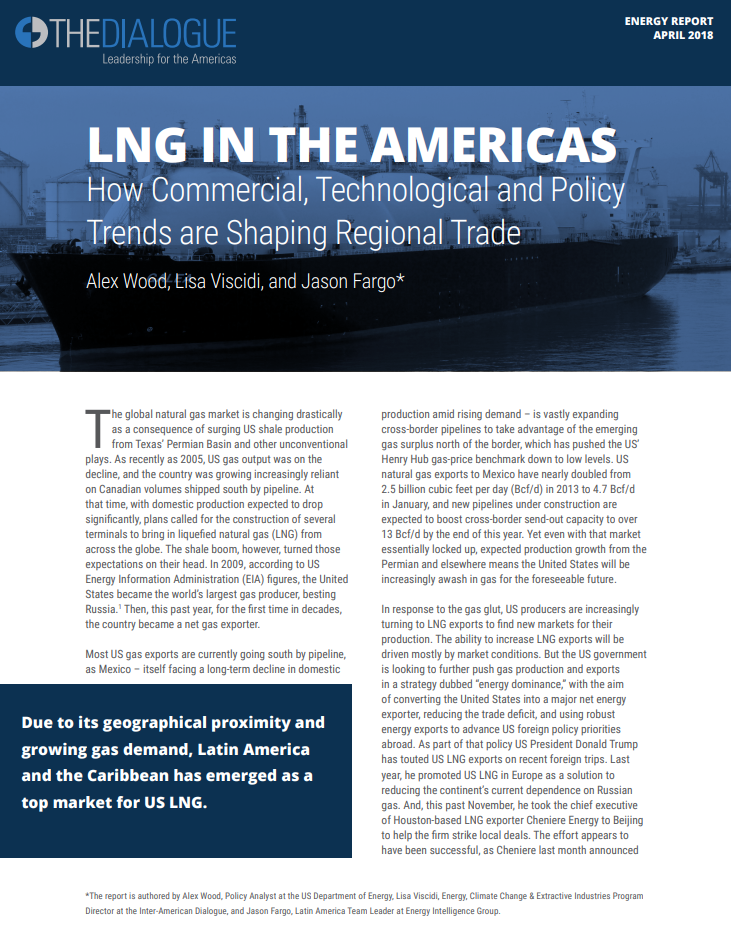

The global natural gas market is changing dramatically as a result of surging US shale production. Due to its geographical proximity and growing gas demand, Latin America and the Caribbean has emerged as a top market for US LNG, according to a new report by the Inter-American Dialogue, LNG in the Americas: How Commercial, Technological and Policy Trends are Shaping Regional Trade. The next few years will see a major shift in the hemispheric natural gas trade, as increased US LNG exports increasingly displace volumes from other exporters, argue the authors. Key takeaways from the report include:

Commercial developments, such as more flexible contract terms, and emerging technologies like small scale and floating LNG, are making regional gas trade more liquid and allowing new markets to open up. Policy developments will also impact LNG trade in the Americas, from proposals in the US to facilitate small-scale LNG exports to new restrictions on large hydroelectric dams in Brazil.

The report is authored by Alex Wood, Policy Analyst at the US Department of Energy, Lisa Viscidi, Energy, Climate Change and Extractive Industries Program Director at the Inter-American Dialogue, and Jason Fargo, Latin America Team Leader at Energy Intelligence Group.

Unless resource nationalism can be made compatible with providing incentives for significant foreign participation, it may be too early to start trumpeting a bonanza for Latin America.

Natural gas has the potential to reduce Central America’s high energy costs and mitigate its dependence on imported oil.

Oil and gas production in the United States and Canada has increased considerably since 2008.