China’s Strategy in Brazil & the Southern Cone

What does China stand to gain from investing in Latin America’s energy projects? Where is China looking next in the region?

What does China stand to gain from investing in Latin America’s energy projects? Where is China looking next in the region?

With the recent decline in commodity prices, why have some countries have fared better than others?

Brazil’s oil and gas and electricity sectors are an important destination for Chinese direct investment.

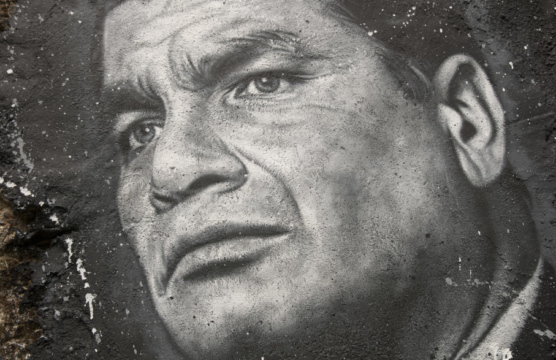

Ecuadordan President Rafael Correa battles an increasingly dissatisfied citizenry as he implements fiscal reforms to counter dropping oil prices.

Comparatively high rates of energy use in China and Brazil have led to investment in many forms of energy, including renewables.

Latin America, a region facing growing demand, has become the main destination for US oil product exports.

Despite its prodigious petroleum reserves, many countries in Latin America are experiencing declining production. What explains the paradox?

Oil and gas production in the United States and Canada has increased considerably since 2008.

What are the challenges and best policies for managing Colombia’s oil and mining revenues?

Will Cuba be able to safely regulate its oil industry?

Brazil has vast oil reserves, but can the Bolsonaro government get the energy to market? Lisa Viscidi tells Richard Miles of CSIS that reforms are already in place that will enable oil production “to take off.” The real obstacles are the financial stability of Petrobras, the shaky state oil conglomerate, and the monopoly that the state has on most aspects of energy production, delivery, and even retail sales.

In the wake of the pivotal 2023 Argentine election, the Inter-American Dialogue convened a group of experts on November 21 to weigh in on energy policy under a Milei administration.

Lisa Viscidi, director of the Energy Program, gave a presentation to the Federal Energy Regulatory Commission on Mexican energy policy under AMLO and its implications for US-Mexico energy trade.

La directora del Programa de Energía, Cambio Climático e Industrias Extractivas, Lisa Viscidi, habló con NTN24 sobre el ataque de una refinería en Arabia Saudita, que cortó más de la mitad de su producción del petróleo.

2019 marks the first year since new leaders in Brazil, Colombia and Mexico took office. We can now see more clearly the way their policy decisions have affected the energy sector and opportunities for investment. Meanwhile, Argentina holds presidential elections later this month. Venezuela, in turn, faces a worsening economic crisis as oil production plummets. Industry experts, government officials, and corporate representatives convened to discuss these issues and their regional impacts on October 2 at the Inter-American Dialogue.

Video

Video

Video

Video

Video

Video

Video

Video