China, India & Colombia’s Interbolsa

Colombian firm Interbolsa is being liquidated in a move to protect the interests of Colombia’s financial markets.

Political divisions continue to undermine Central America’s regional electricity market, in spite of the many benefits, such as lower electricity prices and increased investment. But an upcoming presidential election in Guatemala opens an opportunity to rekindle regional integration with new leadership in Central America’s largest country.

Guatemalan voters will cast their ballots in the first round of presidential elections on September 6, and the outcome remains uncertain. The frontrunner, Libertad Democrática Renovada Party candidate Manuel Baldizón, has seen his lead diminish in the polls to 25%, with his campaign mired by political scandals and overspending. His closest contender, Frente de Convergencia Nacional candidate Jimmy Morales, a comedian and new face in Guatemalan politics, has enjoyed a sudden spike in popularity to 16%. In third place, Unidad Nacional de la Esperanza candidate Sandra Torres’ popularity has been stable at about 15%. Several lower-polling candidates also remain in the race. With no candidate likely to receive over 50% of the vote in the first round, a second round on October 25th is all but certain.

The new president will have many issues to tackle upon taking office, including widespread corruption, violence, and drug-trafficking, large numbers of migrants fleeing to the United States and an overall loss of trust in government. Current President Otto Pérez Molina has seen his popularity plummet as members of his government face corruption allegations, and thousands of citizens are calling for his resignation.

As Guatemala struggles with these political challenges, the country will also face a growing need for reliable, affordable electricity, a critical input to economic growth and development. The Guatemalan government projects that electricity demand will increase to approximately 16,000 GwH by 2025 compared to some 10,000 GwH today.

The Central American regional electricity market is central to addressing many energy security issues in Guatemala and the rest of isthmus. The completion in October 2014 of the 1,790 km Central American Electric Interconnection System (SIEPAC) transmission line and establishment of the Regional Electricity Market (MER), a seventh market that allows electric power exchange between the six Central American national markets, have laid an important foundation for regional electricity integration, though more must be done to meet rising energy demand, as panelists noted at an Inter-American Dialogue meeting in April. The SIEPAC transmission line has capacity of 300MW, about 5% of Central America’s total demand. And though use of the line has tripled within two years, its capacity is still not fully utilized by the six interconnected countries. Strengthening and eventually expanding this interconnection is crucial, as Central America will require a 26% increase in power generation capacity over the next decade to keep up with projected GDP growth, according to the US State Department.

In order to take full advantage of SIEPAC, a number of political, operational, and technical barriers must be overcome. Reinforcements to national grids must be made by each of the six Central American countries. Honduras and Nicaragua are the farthest behind in strengthening their national infrastructure and often use SIEPAC as part of their national transmission grids, preventing it from being used entirely for regional electricity market operations. Investing in SIEPAC transmission lines is expensive and can be politically challenging as some national providers do not want competition from the regional grid. However, if transactions in the MER are sufficient they could eventually pay for 80-100% of the cost of the infrastructure investments and allow countries to reduce electricity costs by buying and selling larger volumes on the regional market.

In order to incentivize much-needed investment, the MER’s regulatory framework must be strengthened. This includes determining the cost of transmission rights and tolls for transmitting electricity across multiple borders, as some distributors are currently reluctant to use SIEPAC because charges vary greatly and the cost of transmitting electricity across multiple borders can be very high.

Long-term power purchase agreements on the regional market must also be made available to guarantee a minimum number of transactions on the market and provide more security for large, multi-country investments. Currently, contracts are available for a maximum of one year, and member countries have not included buying and selling on the MER in their national energy plans. Instead, power is exchanged on a case-by-case, short-term basis when countries have extra electricity or need additional supply.

In addition, harmonization of national and regional regulations remains inconsistent across countries. Different taxes and pricing rules are applied in each of the six countries. Each country prefers to sell power to the grid than to buy it, and prioritizes investments in domestic generation over strengthening regional transmission capacity.

Further expanding the regional grid beyond Central America is also necessary. Extending the line to connect to Mexico and Colombia would increase the number of transactions in the regional market and lower electricity costs, as Mexico and Colombia both have access to cheaper sources of power generation. This would in turn provide incentives for further investment to expand the grid. The Interconexión Eléctrica Colombia Panamá has already been given the green light by the Colombian government and is pending approval from Panama. In addition, a second circuit has been proposed to double SIEPAC’s capacity to 600MW.

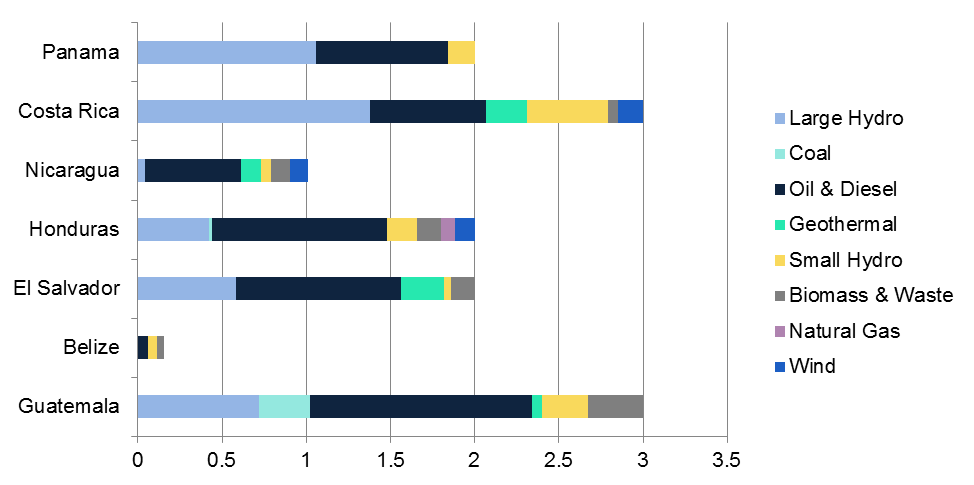

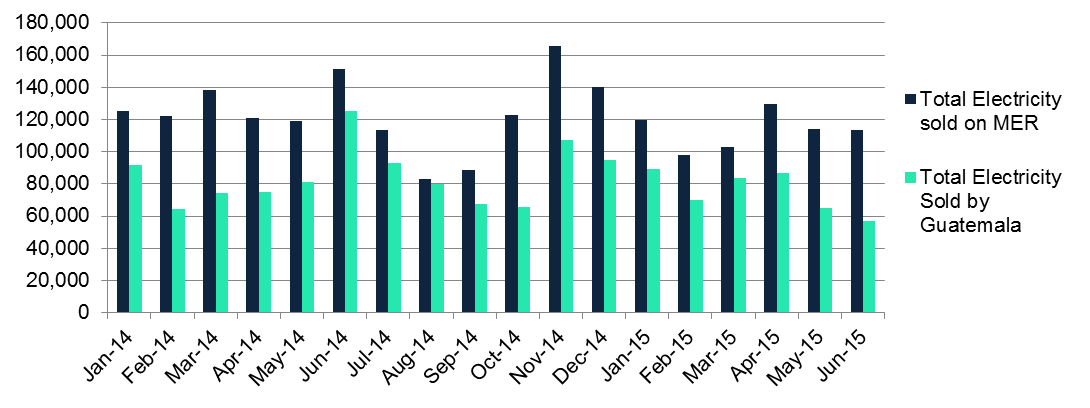

Guatemala is a key player in resolving these challenges. It has made important investments in reinforcing its national grid and produces lower-cost power than most other Central America countries, which it sells to the regional market, providing neighboring countries access to cheaper electricity. It routinely sells the highest percentage of electricity to the MER of all six countries (see chart below).

In addition, Guatemala is uniquely positioned, both geographically and strategically, to work with Mexico towards integrating the Mexican grid with SIEPAC. Guatemala already has access to inexpensive electricity thanks to its 200MW connection with Mexico. However, while Guatemalan consumers benefit from Mexico’s low electricity prices, the country sells higher-priced power produced domestically to the regional market. This has angered stakeholders in other Central American countries and contributed to the erosion of trust between political actors in the region. In Central America, Guatemala is widely viewed as prioritizing its domestic energy interests over benefits for the region as a whole.

However, in order for Mexico to sell directly to SIEPAC, it would have to adhere to complicated technical cooperation agreements, including demonstrating that equipment and installations are compliant with established technical requirements, harmonizing regulations and legislation, and eliminating technical and commercial barriers. Guatemala can play a central role in advancing this integration, having already negotiated a bilateral Memorandum of Agreement for its electricity connection with Mexico in 2003. Guatemala has also negotiated a range of other agreements with its northern neighbor including 12 deals signed in May on themes ranging from drug and arms trafficking controls to the potential for a new natural gas pipeline to connect Mexico to Central America.

There are still many obstacles to fully capitalizing on the potential benefits of SIEPAC, but the possibility of developing larger-scale and more efficient regional electricity projects is promising. The line has already proven useful – SIEPAC links 37 million people across six countries, and transactions in the MER already exceeded 1,500 GwH for the year in July 2015.

Though the new Guatemalan president will face many pressing domestic issues upon taking office in January, fomenting increased regional energy integration through investment and cooperation with Mexico should be among his or her foreign policy priorities in order to increase energy security, meet growing electricity demand and show regional leadership.

Colombian firm Interbolsa is being liquidated in a move to protect the interests of Colombia’s financial markets.

What is the state of Peru-China commercial ties today?

Venezuelan president Nicolas Maduro left China last month with a supposed show of support from the Chinese government.