The New Banks in Town: Chinese Finance in Latin America

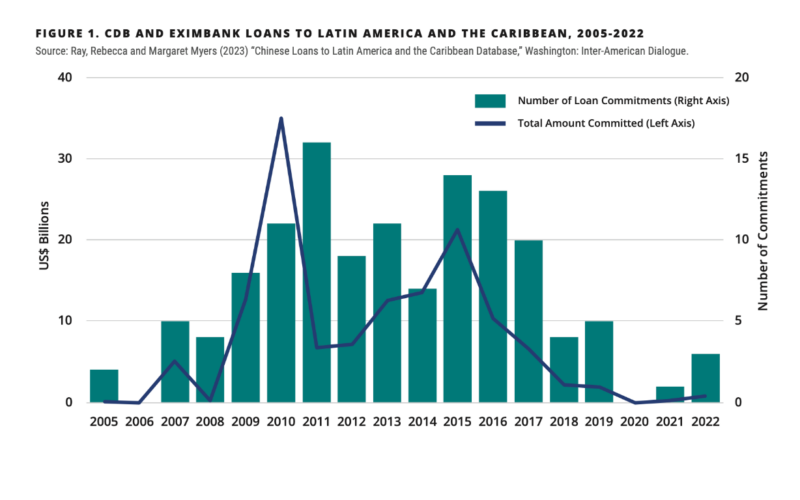

Estimates of the volume, composition, and characteristics of Chinese lending to the region since 2005.

On March 29, Asia and Latin America Program Director Margaret Myers and Rebecca Ray joined Eric Olander of the China-Global South Podcast to discuss their new report, At a Crossroads: Chinese Development Finance to Latin America and the Caribbean, 2022, their updated Chinese Loans to Latin America and the Caribbean Database, and emerging trends in Chinese economic engagement with the Latin American and the Caribbean (LAC) region.

"Recently, I've enjoyed saying, ‘The BRI is dead, long live the BRI.’ By that I simply mean [the BRI] will live on in perpetuity but has changed in many ways. We are also seeing other initiatives being announced, as well as a rethinking of the ways in which China is engaging globally, whether in the financial realm or otherwise.”

"In addition to the challenges that China is encountering servicing its overseas loans, there are many other reasons why we are seeing a slowing of development finance institution credit in the region. One is that Venezuela is essentially off the map. There is no lending to Venezuela at all and there hasn’t been for a number of years now. For many years, it accounted for the vast majority of Chinese finance in the region. Another, in my mind at least, is that these loans, especially these sovereign loans, were largely intended to help Chinese companies to establish a presence in the region in the first place, to establish a footprint, to develop the sorts of networks that they would need to be able to engage effectively and compete effectively with other companies in the region. And now they’ve achieved that objective, largely.”

"There is a very strong interest and a sustained interest for a very long time in engaging with the Caribbean and issuing loans.”

“They are not multi-billion dollar loans in most cases. They are smaller loans, but the Caribbean has been a feature of Chinese finance for many years and again, this year saw two loans issued to the Caribbean. But also in years past, even amid Covid, we saw continued engagement with and negotiation with the Caribbean on wide-ranging issues of interest to that particular region.”

“There are a lot of countries approaching China right now with projects of interest. Also, Chinese companies continuing to identify projects of interest, whether we are talking greenfield projects or mergers & acquisitions. . . . [There are] a lot of activities still. The question is what will materialize, what are the constraints, how is China viewing risk, and how many resources can it bring to bear.”

“What we are talking about here are development finance institutions, China Development Bank and China Export-Import Bank. But, there are other sources of finance that are supporting a lot of the project development that we are seeing across the region and that includes the commercial banks . . . and Chinese companies bringing their own finance.”

“A lot of these countries are not going to be attractive investment environments for Chinese companies at least when taking into account financial considerations, just as they are not for a lot of international companies.”

“It is not as though this drop in lending, and especially sovereign lending, will result in no activity whatsoever. There are other means to push these projects forward. It will be a matter of articulating very clearly what [LAC] countries need and then understanding how that aligns with Chinese interests.”

“Officials will note that the . . . numbers reflect a slowing of activity in this particular space. But, in general, the focus is on broader trends, including in terms of investment and trade. A lot of China’s economic influence is coming from the trade dynamics at play, so I don’t know that [US government officials] see this particular shift in finance as changing the overall dynamic or reducing considerably China’s influence, which is largely based on wide-ranging forms of economic engagement in the region.”

“[Honduras's] decision was made, in my view at least, on the prospect of securing finance for the Patuca II dam project.”

“The outcomes vary considerably on a case-by-case basis when countries cut ties with Taiwan and establish them with China.”

“I think looking ahead we are going to see a lot of the same sort of trends that we have seen over the past two to three years. One is continued localization of activity and dealmaking. . . . We are [also] going to see a focusing of economic activity I think on those sectors that China deems most critical to its own economic growth objectives.”

Estimates of the volume, composition, and characteristics of Chinese lending to the region since 2005.

Argentine President Cristina Fernández has increased her appeals to nationalist sentiment to build domestic political support.

Honduras is in the midst of a security crisis, with alarming levels of official corruption and the world’s highest homicide rate.

Video

Video