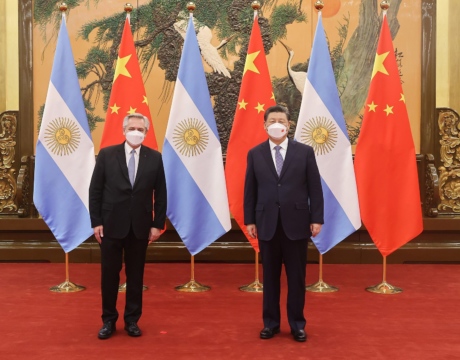

Chinese Finance in Argentina

A recent Economist article discussing Sino-Argentine relations cited to commercial loan statistics from the Asia and Latin America Program’s China-Latin America Commercial Loans Tracker.

Q: The Paris Club said last month that it is open to a discussion about Argentina's debt after the South American country outlined conditions for repaying the roughly $9.5 billion that it owes to the group of creditor nations. What would the advancement of talks between Argentina and the Paris Club mean for the country? What stands in the way of a breakthrough? How urgent is it for Argentina to strike a deal with the club on its debt?

A: Cecilia Nahón, Argentina's ambassador to the United States: "Following the default in 2001, and under a new government, Argentina underwent a successful debt restructuring process accepted by almost 93 percent of the country's creditors. A sustainable debt management strategy favored economic growth and debt servicing, including early cancellation of all IMF obligations in 2006. As a result, debt as a percentage of GDP declined from 166 percent in 2002 to 44 percent in 2013--with public external debt being only 13 percent of GDP--providing Argentina with strong foundations for sustained economic growth. In recent months, Argentina has also settled its outstanding investment-related awards at ICSID. On January 21 in Paris, Argentina's Minister of Economy, Mr. Kicillof, met with high officials of the Paris Club, taking a relevant step towards the normalization of Argentina's debts with member countries. To this end, Argentina has initiated an open dialogue with Paris Club authorities. The country's proposal for the main guidelines of an agreement met with a positive reception among Paris Club members, confirming ongoing discussions are on the right track. As stated by the Minister of Economy, Argentina will abide by its commitments to the Paris Club and is determined to find a definitive solution. It should be noted that the debt with the Paris Club inherited by the current government dates back many decades, including to the military regimes. The guiding principle of Argentina's proposal is based on the concepts of debt sustainability and repayment capacity. The paramount importance of debt sustainability, first discussed by former President Néstor Kirchner, ensures that debt payments will never jeopardize Argentina's model of growth with social inclusion."

A: Miguel Kiguel, executive director of Econviews in Buenos Aires: "Argentina seems to be serious this time about reaching an agreement with the Paris Club to restructure roughly $9.5 billion in debt that is currently in default. This is not the first time that Argentina has tried to settle the issue. Back in 2008, President Cristina Fernández de Kirchner announced that Argentina was going to pay in full the debt in cash, but this initiative was frustrated by the Lehman financial crisis and the outflow of international reserves. One of the main obstacles in the negotiations in the past was Argentina's reluctance regarding the involvement of the International Monetary Fund. Typically, in Paris Club agreements there is also an IMF program. In this case, Argentina did not want any type of IMF involvement because it was concerned about criticisms over the consumer price index and growth statistics, which have been manipulated by the government since 2007. The big news is that Argentina appears to be more transparent again with its inflation numbers, as it published 3.7 percent inflation in February, a figure that was much higher than the market was expecting and closer to reality. This new attitude has opened the possibility for the IMF to undertake the annual review of the Argentine economy and to reach an agreement with the Paris Club. This initiative is in line with the recent agreement to pay Repsol $5 billion for the expropriation of YPF and to settle the cases at the International Centre for the Settlement of Investment Disputes. It is very likely that Argentina will finally reach an agreement with the Paris Club, though we should expect a complex negotiation that will take time and will require willingness to compromise on both sides."

A: Fausto Spotorno, director of research at Orlando J. Ferreres & Asociados in Buenos Aires: "Argentina needs hard currency. The central bank's foreign currency reserves were dropping very fast at the beginning of this year, which led to a devaluation of 25 percent and an increase of interest rates by 1,200 basis points in just a few weeks. This way, the central bank has created a 'bridge' to the second quarter when the dollars will flow in after a very good soybean harvest. After that, the second half of the year will be difficult, and foreign currency reserves will probably resume the downward trend because the trade balance surplus will be lower and debt payments will be higher. Therefore, the government needs international financing to rebuild international reserves and avoid an exchange rate crisis by 2015, which is the last year of the current administration. This requires an improvement with the Paris Club, ICSID, World Bank and other international organizations. However, that may be difficult if there is no agreement with the IMF, something the government does not want, because it could have a high political cost. However, to evaluate the urgency of this agreement, it's important to understand that the real priority for the government, right now, is not an agreement with Paris Club but to obtain a hard currency loan."

A: Claudio Loser, senior fellow at the Inter-American Dialogue and former head of the Western Hemisphere Department at the IMF: "Three blocks of obligations have burdened Argentina, even as it concluded the unilateral solution to its external debt to the private sector in 2005: the obligations arising from the World Bank-housed arbitration tribunal, or ICSID, the outstanding debt to holdouts to the 2005 restructuring, and the Paris Club debt that is owed to foreign governments. Some progress has been observed regarding the first block, and Argentina is likely to lose its appeal in the U.S. courts on the second. The Paris Club is important well beyond the outstanding debt. If there is no settlement, advanced countries will not guarantee loans for the purchase of imports that Argentina so desperately needs, and there will be little sympathy for Argentina in foreign courts and at the IMF and World Bank, at a political level. This closes one of the main financing avenues for fund-strapped Argentina, at a time when the country faces its most serious economic crisis since 2001-02. Until two years ago, Argentina could count on strong and growing commodity prices. Now this is gone, and domestic policies are at best very weak. Argentina thought it could have a solution based on the soft terms it presented, claiming sovereign rights, without considering that, on the other side, there are other sovereign bodies, albeit very pragmatic ones in their approach. Under these conditions, any solution will take considerable time to materialize, to the detriment of Argentina."

A recent Economist article discussing Sino-Argentine relations cited to commercial loan statistics from the Asia and Latin America Program’s China-Latin America Commercial Loans Tracker.

Pedro Ignacio Guridi / CC BY-SA 2.0

Pedro Ignacio Guridi / CC BY-SA 2.0