China, India & Colombia’s Interbolsa

Colombian firm Interbolsa is being liquidated in a move to protect the interests of Colombia’s financial markets.

The Dialogue is pleased to feature the following excerpts from “Too Big to Fail?: China’s Economic Presence in Latin America,” by Guo Jie (??), assistant professor and Latin American affairs expert at Peking University and former Chinese scholar-in-residence at the Inter-American Dialogue. Her new article, to be published in China International Strategy Review, offers a comprehensive evaluation of the China-Latin America relationship from a Chinese perspective. The full text in Chinese can be downloaded below.

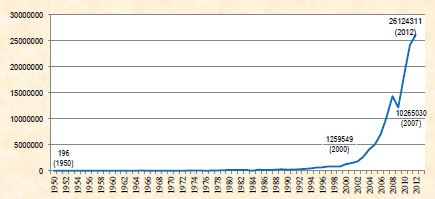

China’s economic growth over the past ten years has become an important factor for Latin America’s development. Trade between the two parties has skyrocketed. Significant increases in Chinese foreign direct investment (FDI) in Latin America have also attracted attention.

Sensational accounts, both positive and negative, of China’s presence in the Americas have failed to capture the multiple dimensions of Sino-Latin ties. It is undeniable that China has achieved significant expansion in the Western Hemisphere. However, a lack of balanced engagement and insufficient incentives for sustainable development remain equally apparent.

A “win-win” scenario is not a far-fetched notion, but a realistic demand by both sides. Driven by this desire, the China-CELAC forum has the potential to alleviate points of tension and broaden future opportunities for Chinese relations with Latin America. Whether such goals can be achieved depends on trust, understanding and collaboration from all parties.

The diversification of trade and investment between China and Latin America presents an opportunity for both parties to strengthen and sustain economic relations. Economic ties between China and the region have diversified more rapidly recent years, largely due to four factors:

Chinese companies operate across numerous sectors in Latin America. Multinational companies in industries such as telecommunications, personal computers, automobiles, household appliances, televisions and heavy machinery have developed rapidly in major Latin American economies such as Brazil and Mexico. Corporations in other sectors — including agriculture, electricity and renewable energy — have also gained a foothold in the region. When China officially joined the Inter-American Development Bank in 2009, Chinese financial institutions accelerated their expansion in Latin America.

Although a degree of diversification is evident, large asymmetries persist within between countries and sectors. The largest share of China’s investment has been allocated in South America. China’s investments in Brazil and Argentina have also diversified to a greater extent than those in other Latin American countries.

The China-CELAC forum proposed by China was officially approved in 2014. China expects to take advantage of this opportunity to deepen cooperation with Latin American partners and achieve greater degree of diversification. To do so, officials need to have a clear understanding of major commonalities and differences among Latin American countries. It is important that China recognize each member country’s distinct identity and expectations and openly articulates its own vision and objectives from the outset in order to avoid any unnecessary misunderstanding. As former Premier Wen Jiabao acknowledged, “the pursuit of common interests lies at the core of China-Latin America relations.” Identifying these common interests is essential for promoting sustainable development between China and Latin America.

| Date |

Investor |

Investment activities |

| Oct-93 | CNPC | Block 7 in Talara Oilfield, Peru |

| Jul-95 | CNPC | Block 6 in Talara Oilfield, Peru |

| Jun-97 | CNPC | Caracoles and Intercampo Oilfields, Venezuela |

| Jun-01 | CNPC | Orimulsion Cooperation with PDVSA |

| Aug-03 | CNPC | Block 11 of Amazon Project, Ecuador |

| Nov-03 | CNPC | Purchased 45% stake of the Argentine company PLUSPETROL on Block 1-AB/8 in Peru |

| Dec-03 | SINOCHEM | Purchased CRS Resources (Ecuador) LDC from ConocoPhillips Co. of USA. Its asset concludes 14% of the interests of Ecuador Block 16. |

| Aug-05 | CNPC and SINOPEC | Jointly purchased oil and gas assets and development rights and interests of five blocks owned by Encana in Ecuador, and established Andes Petroleum Ecuador Ltd. |

| Dec-05 | CNPC | Signed risk exploration contracts with Peru’s Ministry of Energy & Mining covering Block 111 and Block 113 in the MDD basin. |

| Aug-06 | CNPC | Signed a joint venture agreement on Zumano Oilfield in Venezuela with PDVSA. |

| Sep-06 | SINOPEC | OVL and SINOPEC Jointly bid for 50% stake in Omimex de Colombia. Each of them has 25% stake. |

| Mar-07 | CNPC | Joint venture for exploration, drilling and upgrade the super-heavy oil with PDVSA on Block Junin 4 in the Orinoco heavy oil belt in Venezuela |

| May-09 | SINOPEC and CNOOC | Jointly purchased all assets of Talisman in Trinidad and Tobago |

| Oct-09 | SINOCHEM | Acquired 100% equity of Emerald Energy PlC, which includes 50%-100% rights and interets of 8 blocks in Colombia and 100% rights and interests of block 163 in Peru. |

| Mar-10 | CNOOC | Estbablished a 50% 50% joint venture with Argentina’s Bridas Energy Holdings. |

| May-10 | SINOPEC | Purchased 40% stake of Peregrino Oilfield (Brazil) from Statoil ASA. |

| Oct-10 | SINOCHEM | Won concession of five blocks in Peru: blocks 178, 185 and 165 in Marañon field and Blocks 173 and 175 in Ucayali field. |

| Oct-10 | SINOPEC | Purchased 40% stake of Repsol Brazil |

| Dec-10 | SINOPEC | Purchased all assets of Occidental Petroleum Corp.’s Argentine oil and gas unit |

| Dec-10 | CNPC | Signed a joint venture operation agreement with PDVSA on Block Junin 4 in the Orinoco heavy oil belt. |

| Feb-11 | CNOOC | Pan American (owned by Bridas Corp — itself co-owned by China’s CNOOC and Argentina’s Bulgheroni family) purchased an oil refinery and more than 700 service stations in Argentina, Paraguay and Uruguay from Exxon Mobil Corp |

| Nov-11 | SINOPEC | Purchased 30% stake in Galp Energia SGPS SA (GALP)’s Brazilian unit |

| Dec-11 | SINOCHEM | Purchased 10% stake of the Brazilian unit of French oil and natural-gas company Perenco SA in five offshore blocks in the Espirito Santo Basin |

| Feb-12 | SINOCHEM | Purchased TEPMA BV (Total SA’s Colombian assets), which has a stake in the Cusiana field as well as shares in the OAM and ODC pipelines in Colombia. |

| Oct-13 | CNPC and CNOOC | Formed a consortium with other oil companies and won the concession of exploration and extractions in Libra oilfield (Brazil). CNPC and CNOOC each has 10% stake. |

| Nov-13 | CNPC | Purchased Petrobras’s Peru unit. |

Note: the sources are diversified, including websites and reports of the companies, publication of government authorities such as SASAC, MLR and MOFCOM, and database of think tanks such as the Heritage Foundation.

|

Country |

Energy | Mining | Agriculture | Finance | Automobile | Chemical | Real Estate | Telecom |

| Brazil |

7* |

4 | 2 | 4 | 4 | – | 3 |

2 |

| Venezuela |

1 |

1 | – | – | 1 | – | – |

– |

| Peru |

1 |

7 | 1 | – | – | – | – |

– |

| Argentina |

3 |

– | 1 | 2 | 1 | 1 | – |

– |

| Chile |

2** |

2 | – | – | – | – | – |

– |

| Ecuador |

1 |

2 | – | – | – | – | – |

– |

| Colombia |

2 |

– | – | – | – | – | – |

– |

| Mexico |

– |

2 | – | – | – | – | – |

– |

| Jamaica |

– |

– | 1 | – | – | – | – |

– |

| Bahamas |

– |

– | – | – | – | – | 1 |

– |

| Trinidad & Tobago |

2 |

– | – | – | – | – | – |

– |

|

Amount |

346.7 | 171 | 42.3 | 20 | 16.2 | 10.1 | 9.6 |

3.5 |

Notes: Original data from the Heritage Foundation. The author has edited it based on comparison with other sources. The table presents the results of the author’s confirmation and calculation. *Two of the seven are State Grid investment; the others are oil and gas investment. **One is solar energy and the other is wind power.

Colombian firm Interbolsa is being liquidated in a move to protect the interests of Colombia’s financial markets.

What is the state of Peru-China commercial ties today?

Protests in Brazil are currently the focus of discussion and debate within Chinese government institutions.