LAC’s Growth Prospects: Made in China?

The following is World Bank Chief Economist for Latin America and the Caribbean Augusto de la Torre’s summary of the Bank’s“LAC’s Long-Term Growth: Made in China?,” a recently published report discussing China’s effect on long-term growth in the region. You’ll find the original post on the World Bank’s Latin America & Caribbean blog.

Global turmoil. Growing prospects of another recession. Crisis in the Eurozone. China’s role as a global growth and recovery engine thrown into question.

The current situation looks worrying enough as it is for Latin America –and the rest of the world for that matter- but the region’s growth prospects should be looked at beyond the current juncture and on the merits of its long-term strengths.

Here’s why. The last ten years or so have been very good for many countries in Latin America and the Caribbean. They have witnessed the consolidation of a stable and resilient macro-financial framework, relatively high growth rates, and advances in the equity agenda.

This new economic face of the region was perhaps most clearly portrayed by a rather robust performance, especially of South American countries, in the context of the recent global crisis. In effect, compared to the middle-income country average, the region’s recession in 2009 was relatively short-lived and, with the notable exception of Mexico, remarkably mild, which helped to make its recovery in 2010-2011 stronger.

So, a key question is whether LAC countries, that have so far experienced strong growth during the 2000s, can avoid a self-inflicted boom-bust pattern and rather turn what has been so far a vigorous cyclical recovery into a higher rate of trend growth.

The very fact that these countries have been confronted at this stage with inflationary pressures arising from capacity constraints is a clear reminder of a rather sad reality—that the region tends to bump against “structural speed limits” at comparatively low growth rates. While the high-performing economies of emerging Asia can sustain annual growth rates in the 6-9 percent range without inflationary consequences, in most of LAC the non-inflationary growth rates that can be sustained over long periods tend to hover around 5 percent or lower.

In a newly released report, “LAC’s Long-Term Growth: Made in China?”, we discuss whether the region’s connection to China —dependent as it is on its natural resource abundance—can be capitalized so as to help LAC enter into a steady process of economic convergence towards the standards of living of the advanced economies—a process that has systematically eluded Latin America for more than a century.

The robust growth observed in the region over the past decade is in fact an important reflection of this connection. Both directly (via trade and increasingly also Foreign Direct Investment channels) and indirectly (mostly via China’s impact on the international commodity prices), China’s role in LAC is far from trivial. Coincidentally or not, productivity growth in the region has surged just as these links have deepened.

Can Latin American leverage on the China connection to escape the middle income trap? The short answer is: so far not really, but perhaps in the future, yes.

A Chinese Mirage?

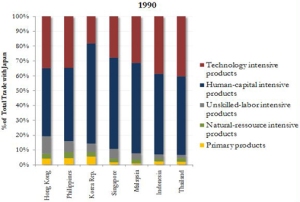

The intensification of trade and other economic links to China matter for sustainable growth only to the extent that they translate into factor accumulation and productivity increases, especially those associated with positive learning spillovers. LAC’s connection to China in the 2000s is reminiscent of that observed between the East Asian economies and Japan from the 1970s to the 1990. Contrasting these two situations can thus shed light on some of the potential spillover effects.

Japan was a fast-growing neighbor with impressive technological progress in the postwar era that acted as a major growth pole, fostering growth in these countries for a long period of time.

Unlike the Japan-Tigers connection, we find so far little evidence that China is fostering productivity growth in the region as Japan did for the East Asian economies in the past. Let’s start with the trade connection.

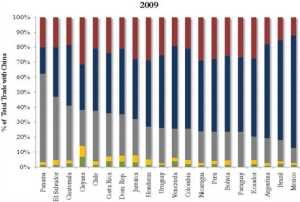

There is no meaningful intra-industry trade(a proxy for the extent of such spillovers effects)between LAC and China. A closer look at the composition of exports and imports between LAC and China (figure 1) show another hint of how this connection differs in nature from that of the Tigers and Japan.

The China-LAC and Japan-Tigers connections appear to differ with respect to FDI growth spillovers, with the former rather limited and concentrated on the acquisition of large firms in natural resource-based industries. In contrast, the golden years of East Asian Tigers were characterized by large flows of intra-industry trade and FDI flows, which led to the development of network-type connections with Japan and among themselves, and significant diffusion of technology and knowledge.

In spite of the disheartening aggregate depiction of LAC’s current connections with China, there are some clear bright spots. There is growing case-study evidence of significant technological modernization, clustering effects, and linkages to other sectors in the production of agricultural commodities in the region—in Argentina, Brazil, Chile, and Uruguay, for example. And there is hard evidence of significant movement up the value chain in the production of mineral commodities—with LAC’s share in the global exports of higher value added (“worked”) metals increasing eightfold over the past 30 years or so.

Developing clustering and production chains not only bring direct benefits, such as employment generation and direct local value added, but also important indirect ones. They can act as catalysts for technology and knowledge enhancement but also capacity-building and economic development more widely, thus leading to virtuous cycles.

While LAC seems to be on the right track, these achievements still pale in comparison to the connectivity developed by the Tigers. Since their early stages of development in the mid-1980s, East Asian countries were highly active in creating linkages and upgrading their production, and have been at the center of global value chains in industries such as electronics and semiconductors.

In sum, while China may be fostering growth in the region by simply absorbing our commodity exports, sustaining their prices, and driving the expansion of LAC’s commodity-based exporting industries, it has played a much more limited role in the diffusion of technology and knowledge spillovers. A central point for policymakers is that trade connections alone—i.e., connections that are not accompanied by, and lead to, human capital formation, investments in innovation, technological adoption and adaptation, and cumulative learning—are unlikely to spur productivity growth. Even more so when export revenue expansion relies solely on buoyant prices of high-rent commodities.

Learning (to produce more and better of the same, and to produce new things) in a globalized economy can come from any place, and not just the export destination country, if the right institutional and policy environment is in place. The absence of the latter may explain why LAC has already missed an opportunity when it could not capitalize on the tight connection it has maintained with the U.S.—a rich and innovative economy operating at the technological frontier—for much of the post-World War II era.

Are there deeper institutional and structural reasons that make Latin America’s economies less able to learn and absorb technology? Much of the region’s handicap is related to lags in human capital, skills, infrastructure, and innovation capacity. The new connection to China will then by itself not change these deficiencies. That is the job of a well-designed and implemented growth-oriented policy agenda –an agenda that is by and large still missing.

Long-term Challenges

Moving forward, even in a context of trade based on comparative advantage forces with China, LAC countries have the potential to leverage their connection to China and make it a blessing. The region, however, faces a tall order in this regard. The overriding challenge on the growth front for LAC’s policymakers is then to harness the opportunities afforded by deeper and broader links to the global economy in general, and to China in particular. In the shorter run, how the region manages the mature phase of the recovery cycle will be crucial in this respect, as it would set the stage for the implementation of a more robust long-run growth agenda.

Beyond the short run, the premium on productivity enhancing policies will need to be raised. Some of the key external conditions for LAC to raise its growth rate sustainably above the world’s average may be in place (large and growing countries with strong demand for LAC exports; high commodity prices; and low world interest rates). Seizing the opportunity on this favorable external environment will require well-designed, but not necessarily numerous or unduly complex, policies to ignite growth, that are adequately tailored to the circumstances of each individual country. The productivity-oriented policy effort however needs to be particularly large to compensate for structural impediments to a competitive exchange rate, namely low domestic savings and high financial integration.