How Important is Chinese Lending to Latin America?

Chinese lending to Latin America and the Caribbean hit an all-time high of $37 billion in 2010.

This blog refers to the “Thriving in San Marcos” initiative carried out in partnership with Cities Alliance and the Swiss Agency for Development and Cooperation.

“Thriving in San Marcos” promotes financial access and inclusion in the MANCUERNA region of Guatemala through financial education in close collaboration with financial institutions. MANCUERNA encompasses municipalities across San Marcos and Quetzaltenango, two departments in the Western Highlands.

In 2020, over 25,000 financial education sessions were conducted, half of which included women. Participants mobilized US$2,400,000 in savings in the financial system and opened over 3,000 new financial products.

“In 2020 and 2021, remittances have broken records and [the Western Highlands municipality of] Salcajá did not fall behind. An estimated 30 to 40 percent of local incomes come from remittances. …

The role that remittances play in our community is very important because other than allowing residents access to basic necessities they also facilitate access to better housing levels because residents utilize their remittances to build homes.”

– Vairo de León, branch manager at Cooperativa ‘Salcajá es MICOOPE’

In Guatemala, the majority of remittance recipients are women, with almost half of whom being indigenous. Financial inclusion strategies offer opportunities to leverage resources for broader development by providing recipients with tools to formalize and build their savings, acquire assets, and invest in better nutrition, education, housing, and living conditions.

Greater inclusion into formal financial systems can help individuals and households build assets, thus fostering rootedness and reducing economic pressures to migrate. In doing so, financial education is an innovative tool for strengthening local migration management.

Gender roles and culture shape the way that women make financial decisions and present certain gender-related barriers to financial education and the financial system.

Supporting female remittance recipients offers opportunities to amplify the impacts of financial inclusion on local development.

For example, women in developing countries invest more than 90 percent of their earnings in their children’s education and health, according to The World Bank; in comparison, men invest 30 to 40 percent. This trend has the potential to break intergenerational cycles of poverty, mitigate the root causes of migration, ensure better living conditions and opportunities for future generations, and make important contributions to international development goals for 2030.

Our work to promote financial inclusion among remittance recipients in Guatemala indicates that our one-on-one financial education sessions successfully motivate people towards accessing financial products and formalizing their savings.

The personalized nature of each session allows financial educators to respond to specific needs and circumstances of urban residents along with women and indigenous groups.

Jorge de León has worked with the Dialogue as a financial educator at MICOOPE’s Cooperativa Salcajá branch in Salcajá for several years. He is familiar with his community and adapts his approach to suit each client.

“It’s important to establish trust with the person and address them with words that correspond to who they are and what they do. We educate all types of people, from laborers to professionals, and every one of them benefitted from financial education… We work with a lot of people who have an indigenous background and speak the Mam dialect.” – Jorge de León

The Dialogue spoke with Don Jorge, as he is known, about an experience that represents financial inclusion as a tool for remittance recipients to reach their financial goals and build stronger local communities.

A woman visited Cooperativa Salcajá whose income was based on her textile business and the remittances she received from her husband. She was a traveling merchant who sold traditional hand-woven fabrics and would frequently commute to Tapachula, Mexico to buy base materials. Locals call Tapachula a sister city to Salcajá because the two cities have several business ties. She ran many risks as both a woman and as a business owner because she would travel over 100 kilometers (over 80 miles) with large amounts of cash. She knew the road she traveled could be dangerous and she wanted to keep her money safe.

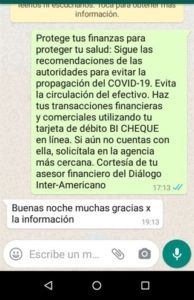

Don Jorge advised her that by opening a savings account, she would be able to keep track of her money better and save up to reach her goals while also making sure she could keep her money secured.

She opened a savings account and acquired a debit card after her financial education session. Weeks later, she returned to talk with Don Jorge because she was not familiar with ATM machines and struggled to use her debit card. Don Jorge connected her with a MICOOPE associate who went with her and guided the woman as she learned how to deposit and withdraw money from the machine. He reminisced about how eagerly she expressed her appreciation for the knowledge she gained because she was able to invest her savings into her business and into repairing her home.

Financial inclusion for female remittance recipients fosters economic prosperity and resilience through immediate impacts and cross-generational effects. By leveraging her remittances, the woman developed a savings mentality. These savings were used to improve her housing condition and increase her own income.

With this additional income, she can invest in better food, education for her children, and better living conditions. Her home will stay within her family and will be passed on to future generations, increasing a sense of stability and rootedness, thus diminishing the need to migrate in the long term.

“Stories like these demonstrate that financial education helps a lot of people in our community because they learn to manage their assets, value their savings, and manage them.” – Jorge de León

About the "Thriving in San Marcos" initiative

Thriving through Business Coaching in Guatemala

Thriving through Extracurricular Education in Guatemala

Rethinking Remittances for Housing and Urban Development in Guatemala

Opportunities for my Community - Guatemala

Addressing the Root Causes of Migration from Central America

Chinese lending to Latin America and the Caribbean hit an all-time high of $37 billion in 2010.

Venezuelan president Nicolas Maduro left China last month with a supposed show of support from the Chinese government.

Summary of PREAL’s recent international conference on teacher effectiveness, held in Guatemala City.