PREAL International Conference 2010: Teacher Effectiveness

Summary of PREAL’s recent international conference on teacher effectiveness, held in Guatemala City.

This post is also available in: Spanish

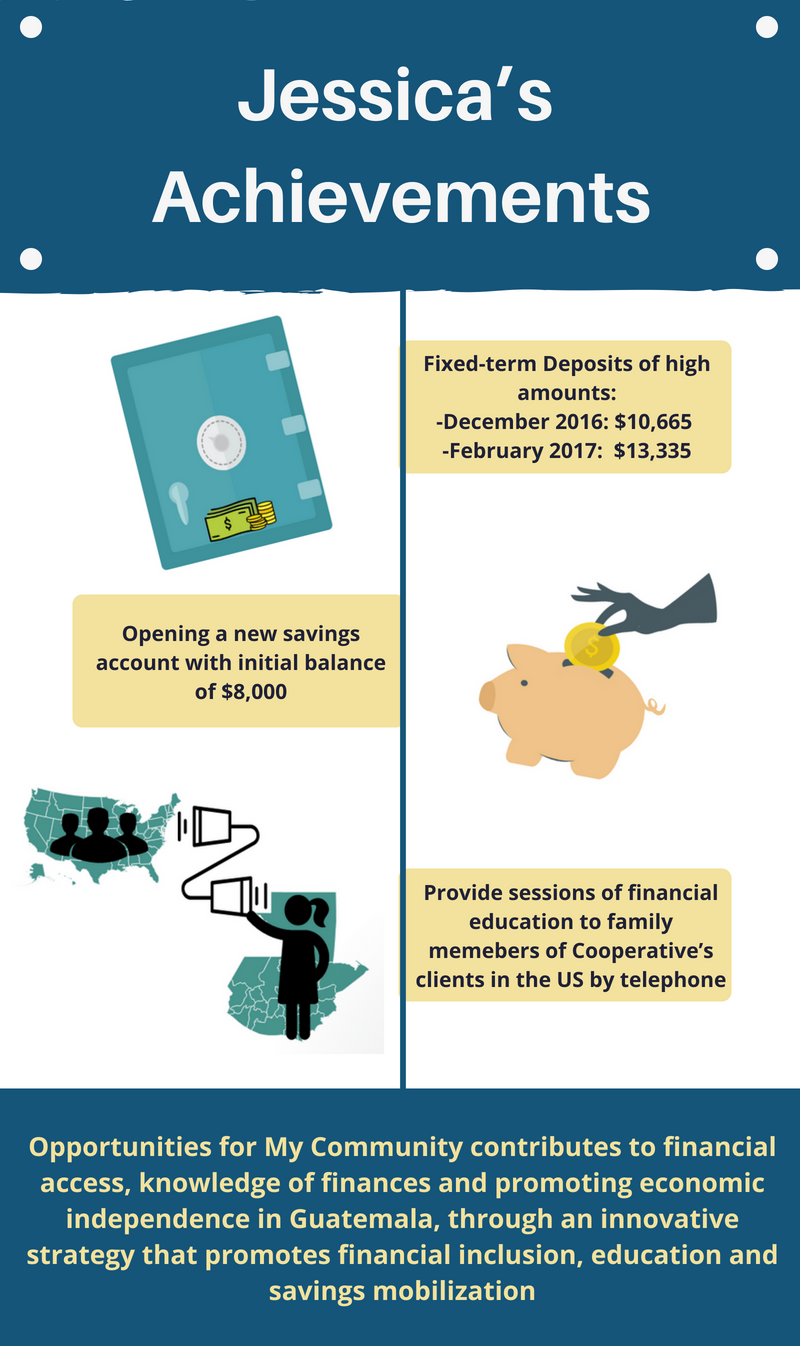

Jessica Noriega first joined the Opportunities for My Community project as a financial educator. Her work was to provide financial education at Cooperative San Pedro in Santa Cruz Barillas, Huehuetenango in the Western Highlands region of Guatemala. In addition to promoting financial inclusion in her community, Jessica always demonstrated a willingness to collaborate with her colleagues at Cooperative San Pedro given her extensive experience in banking and finance. Thus, due to her excellent work, demonstrated commitment, and strong sense of responsibility, Jessica Noriega was promoted to Branch Manager at Cooperative San Pedro.

Previous to joining the project, Jessica worked for a bank for 14 years during which time she accumulated knowledge on financial education and the importance of building assets through the formalization of savings. Thus, for Jessica, it was easy to understand the objectives of the project. She affirms that the methodology she learned during the project’s training is particularly successful because it includes individualized sessions that focus on the specific needs of each client, such as drafting a budget.

Jessica’s work with the project generated impressive results for the Santa Cruz Barillas branch of the San Pedro Cooperative. In six months Jessica performed 996 individual financial education sessions with outstanding outcomes.

According to the data collected during her sessions, 8 percent of the population using the cooperative branch does not have a savings account. This population’s average annual income is Q32,404 ($4,320).[1] Incomes are higher among those who have an account with the cooperative and average Q68,175 ($9,090), and 92 percent of participants at the branch affirm they save in one form or another. Those who do not have a savings account have an average of Q4,492 ($600) in informal savings compared to people who have an account with an average balance of Q17,780 ($2,370). Informal savings are savings that are kept outside of the financial system, including savings that are “under the mattress.”

Jes sica notes that clients generally demonstrate interest in knowing more about savings accounts at the end of her sessions with them. “These people have a lot of debt, wanting to solve everything with loans. With these sessions, I can present them with other options such as saving as a way of achieving financial goals. Many people thank me for what we do. We are helping people and they are responding positively.”

sica notes that clients generally demonstrate interest in knowing more about savings accounts at the end of her sessions with them. “These people have a lot of debt, wanting to solve everything with loans. With these sessions, I can present them with other options such as saving as a way of achieving financial goals. Many people thank me for what we do. We are helping people and they are responding positively.”

According to her records, nearly half of the people who do not have an account save their money at home. Through hard work and diligence, Jessica has convinced 239 persons to formalize their savings by opening an account, which for many, is their first.

In addition to these statistics, project data reveals that people who receive remittances have a strong capacity and potential to save. For example, for participants in the MICOOPE Cooperative system, the average savings balance is Q35,000 ($4,666) among persons who save and receive remittances compared with an average savings balance of Q10,000 ($1,333) for those who save without receiving remittances.

Since the father of her children routinely sends her money from the United States, Jessica is a witness to the ways in which remittances can contribute to improving quality of life. In fact, 29 percent of clients at her branch who receive financial education sessions report receiving remittances of an average of Q3,079 ($410) at least 13 times per year.

Jessica’s work demonstrates that financial education positively impacts peoples’ lives. It also demonstrates that encouraging savings and investment to achieve financial independence contributes significantly to community development. We would like to express our deepest gratitude and thanks to Jessica Noriega, wishing her success as the new Branch Manager of the Cooperative San Pedro in Santa Cruz Barillas, where she will continue her work towards financial inclusion.

Summary of PREAL’s recent international conference on teacher effectiveness, held in Guatemala City.

Links to agenda and media coverage of a conference on the state of the teaching profession in Guatemala.

Business and education leaders discuss business sector engagement in education reform in Latin America.