What Remittances Mean for Latin Americans at Home and Abroad

The emergence of globalization has fostered new transnational networks among migrant communities, and remittances are one way in which they remain connected with their home countries. With over 250 million migrants worldwide, the International Fund for Agricultural Development (IFAD) estimated that remittances “directly touch the lives of one in every seven people on Earth.”[1] In order to raise awareness for this cause, IFAD declared June 16th as International Day of Family Remittances with the goal of “making migration for future generations more of a choice than a necessity.”[2] Today remittances have become a crucial part of the development agenda.

Remittances and Migration

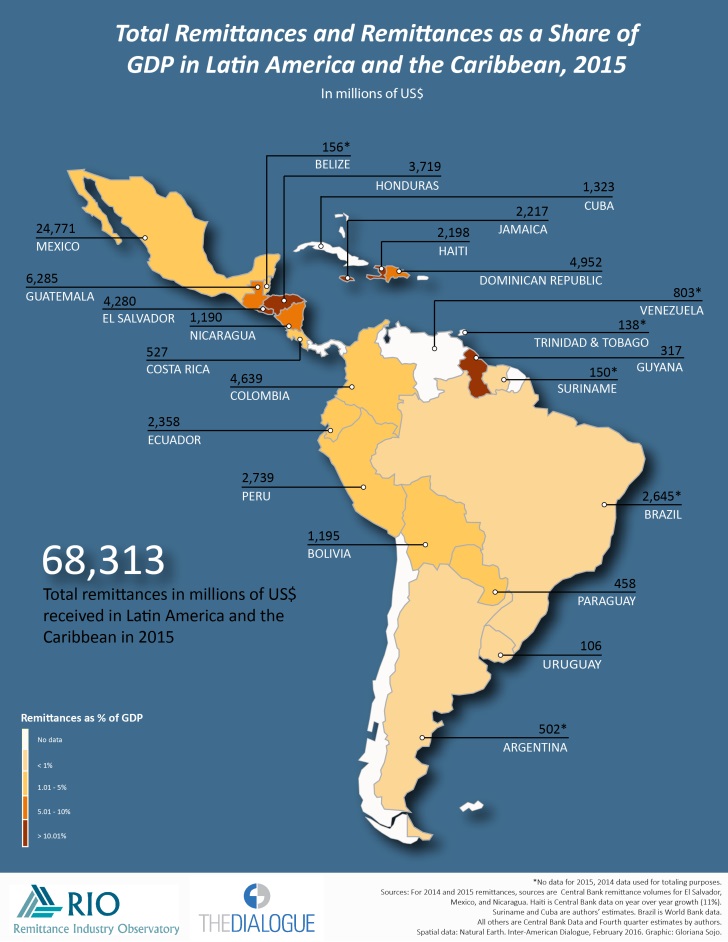

Remittances are stimulating local economies throughout the world and recent trends indicate an overall increase in Latin America and the Caribbean. According to data collected by the Inter-American Dialogue, Latin American migrants sent over $68.3 billion in remittances to the region in 2015, a 5.8% increase from the $64.5 billion they remitted in 2014. Guatemala experienced the largest growth (15.2%), followed by Colombia, Haiti, and Honduras, all with growth rates above 10%, while Haiti had the greatest share of remittances as a portion of its GDP (22.7%), followed by Honduras, El Salvador, Jamaica, and Guyana.

Our research on remittance patterns found that growth in Latin America and the Caribbean is driven by several factors including US economic performance and the region’s level of development.[3] However, the primary driver of remittance growth remains international migration. Although the number of deportations and border apprehensions from the region has increased, it has not affected the overall inflow of migrants in the U.S.

Over the years, undocumented migrants have continued to cross the border, and more people from the region are getting access to temporary work visas.[4] Recent Census data indicates that the number of foreign-born migrants from Latin America in the U.S. grew by 1.94% in 2014 alone, a substantial increase from the low growth rates of less than 1% since the recession.[5] This growth can be attributed to the incoming flow of migrants from Central America, particularly El Salvador, Guatemala, and Honduras.[6] In these areas, migration is largely driven by security concerns, including high homicide and extortion rates, and low levels of economic development. The recent Alliance for Prosperity plan is attempting to address the root causes of migration in the region, but more work needs to be done to invest in human capital, strengthen the labor force, and target the informal economy.[7]

Lastly, our research on this matter shows that growth in remittances is largely caused by an increase in the number of transactions and not by an increase in the average amount remitted.[8] Thus, the rising number of migrants from the region explains the majority of the increased remittance flows to Latin America and the Caribbean as more migrants want to stay connected to their home countries and help their relatives improve their standards of living.

Remittances and Development

Remittance flows have various impacts on economic and social development. Specifically, they affect the wealth of the families that receive them: they increase disposable income and in turn, generate savings in amounts typically larger than the average population. Our work and research has shown that at least 60% of remittance recipients are saving through both formal and informal channels. However, once remittances are received, the challenge for most recipients in low-income economies is the lack of access to financial institutions and services that allows them to formalize their stock of savings.

A large portion of remittance recipients aggregate savings informally because they face geographical, social, business, or legal barriers to access financial services. In some cases, they may not even know they have access to them nor understand the benefits of using such services. For example, many recipients use financial institutions on a regular basis to receive their remittance, but do not hold a checking or savings account with that institution.[9] Thus, there is a key role for practitioners in development to craft policy solutions that focus on financial inclusion, including access to financial institutions, financial education, and technologies to facilitate asset building through savings or regulatory reform. These policies will increase remittance recipients’ ability to save, invest, and build assets that in some cases can even move recipients out of poverty.

On this International Day of Family Remittances, migration from Latin America is both a choice and mostly a necessity. In celebrating the day of family remittances, we are honoring migrants and the impact of their earnings on development, their contributions to host countries’ economies, as well as the efforts, challenges, and sacrifices that accompany an immigrant’s desire to extend their love to their families in tangible ways. Within that context, it is defensible to strengthen the links between migration and development through greater engagement with migrants in all forms possible. Currently there are many international development institutions advocating for greater integration of migration and development. Our challenge is to craft a stronger agenda and equip partners with the resources to promote development through migration.

[1] “International Day of Family Remittances,” International Fund for Agricultural Development, https://www.ifad.org/documents/10180/a9322807-2129-49e3-9ad4-9309ad21f874.

[2] Ibid.

[3] Manuel Orozco, Laura Porras, and Julia Yansura, “The Continued Growth of Family Remittances to Latin America and the Caribbean”, Inter-American Dialogue, https://www.thedialogue.org/wp-content/uploads/2016/02/2015-Remittances-to-LAC-2122016.pdf.

[4] Ibid.

[5] This number includes estimates of both documented and undocumented migrants.

[6] Nina Lakhani, “Surge in Central American migrants at US border threatens repeat of 2014 crisis,” The Guardian, https://www.theguardian.com/us-news/2016/jan/13/central-american-migration-family-children-detention-at-us-border.

[7] Manuel Orozco, “One Step Forward for Central America: The Plan for the Alliance for Prosperity.” Inter-American Dialogue, https://www.thedialogue.org/blogs/2016/03/one-step-forward-for-central-america-the-plan-for-the-alliance-for-prosperity/.

[8] Manuel Orozco, Laura Porras, and Julia Yansura, “The Continued Growth of Family Remittances to Latin America and the Caribbean,” Inter-American Dialogue, https://www.thedialogue.org/wp-content/uploads/2016/02/2015-Remittances-to-LAC-2122016.pdf.

[9] Manuel Orozco and Julia Yansura, “Remittances and Financial Inclusion: Opportunities for Central America,” Inter-American Dialogue, https://1m1nttzpbhl3wbhhgahbu4ix.wpengine.netdna-cdn.com/wp-content/uploads/2015/06/RemitFinancialInclusion_FINAL_223.pdf.