In a new Inter-American Dialogue publication, Iacob Koch-Weser examines Latin America’s role in China’s energy security. He finds that Latin America is often portrayed as a vital commodity exporter to China, but this refers more to agriculture and mining than energy. Brazil and Argentina are among the world’s top-three soybean producers, while Brazil, Peru, and Chile are among the leading suppliers of iron ore and nonferrous metals. At least in terms of goods exports, the relative importance of energy is less pronounced.

So what is LAC’s role in China’s energy security? Some key points:

- Latin America’s current supply of energy to China is predominately oil. China became a net importer of gas in 2006. In addition to pipeline gas from Eurasia, China is receiving maritime shipments of liquefied natural gas (LNG). For the time being, though, LNG shipments stem mainly from the Asian market (Australia and Indonesia) and the Middle East (led by Qatar). China became a net importer of coal in 2008, and in certain months over the past few years has been the world’s largest coal importer. But the main suppliers of coal to China are located in North America and Asia.

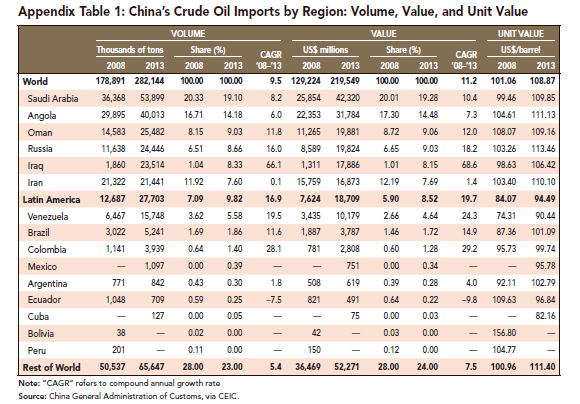

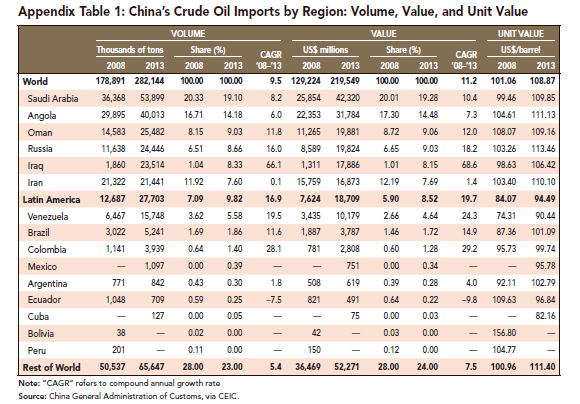

- Latin America is not a major supplier of oil to China. According to China’s own customs data, the region’s share of China’s crude oil imports has increased gradually, from 7 percent in 2008 to 10 percent in 2013, but is less than Angola (14 percent), let alone the Middle East, responsible for about half of China’s imports. Among the 12 members of the Organization of Petroleum Exporting Countries (OPEC), only two—Venezuela and Ecuador—are located in Latin America (compared to four in Africa and six in the Middle East).

With respect to Latin America’s energy production, some important features also stand out:

- Latin America could, in the future, enhance its profile in global energy markets. Venezuela ranks first in the world in terms of proven reserves. Offshore oil discoveries in 2007 suggest that Brazil could one day surpass Venezuela in proven reserves. Latin America holds a larger share of world reserves than production; the inverse of China, which is rapidly depleting its domestic reserve base.

- In energy trade, Latin America is more dependent on China than the other way around. Data from the U.S. Energy Information Administration (EIA) demonstrate that China is a top-3 export destination for Venezuelan and Brazilian crude, even though these countries only account for a small percentage of China’s imports. Although Brazil exports less to China than Venezuela does in volume terms, it is in fact more dependent than Venezuela on the Chinese market.

- Global oil prices have increased over the past decade, but China’s imports from Latin America appear a relative bargain. During the past two decades, China’s rising imports have contributed to an increase in world oil prices above $100 per barrel, causing some to proclaim the end of the “lowcost oil” era. Even the recent oil slump has not returned prices to previous levels. In the context of high prices, Chinese customs data suggests that China is paying less per barrel of Latin American oil than it does for oil from many other parts of the world.

Though not a top energy supplier to China, Latin America is strategically relevant to China’s energy security in other ways, including:

- Transport security. Shipping energy to China across the Pacific could provide an alternative to other transport routes that are unsafe or costly.

- Equity production. Latin America could provide China with greater control over—and involvement in—the production of energy than it might obtain elsewhere.

- Supply diversity. Latin America can expand China’s supply base and reduce its dependence on a select number of large suppliers.

- Increasing aggregate global supply. By investing in or incentivizing production in Latin America, China could increase the global aggregate supply of energy.