China, India & Colombia’s Interbolsa

Colombian firm Interbolsa is being liquidated in a move to protect the interests of Colombia’s financial markets.

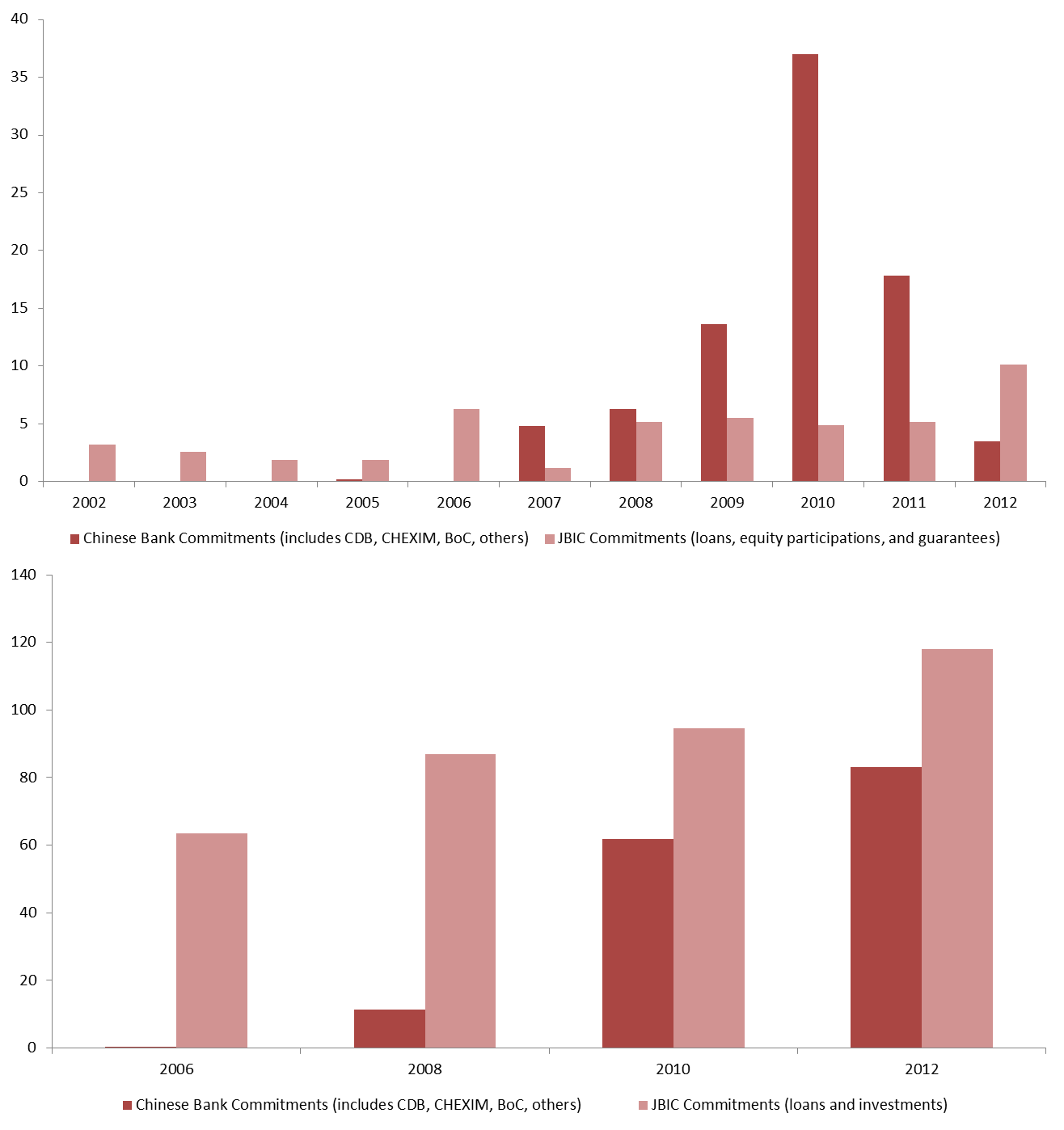

The unprecedented expansion of credit from Chinese policy banks to Latin America has captured the attention of analysts and media alike. Against this backdrop, equally sizeable and growing Japanese lending in the region tends to go overlooked and underreported. But Japanese finance is visible across countries and sectors in the Western Hemisphere. The experiences of Japanese banks also serve as important examples for China and other emerging lenders in Latin America.

Japan’s financial ties to the Western Hemisphere are older and deeper than those of its neighbors in East Asia, though the extent of Japanese lending has fluctuated substantially over time in response to domestic economic conditions. Since the mid 2000’s, Tokyo has re-emerged as a leading source of finance for Latin American countries, particularly Brazil and members of the Pacific Alliance. Most Japanese lending to the region is channeled the Japan Bank for International Cooperation (JBIC) and private financial institutions. A small amount of capital is also pledged as official development assistance, which is primarily provided through the Japan International Cooperation Agency (JICA).

Japan has been a provider of foreign aid since the late 1950’s and is still a major contributor of official development assistance (ODA) to more than 100 countries worldwide. The Japan International Cooperation Agency (JICA), responsible for administering much of the country’s ODA, disbursed more than $10 billion in official aid-related lending in 2012. And though slow growth since the 1990’s reduced Tokyo’s contributions, the country’s leadership is looking to once again bolster Japan’s overseas assistance.

Japanese ODA to Latin America is moderate in comparison to other donor nations. Japan’s foreign aid profile varies widely from country to country, with the greatest effects evident in low-income nations in Central America and the Caribbean. In the years from 2009 to 2011, Japan ranked as the top foreign donor for Antigua and Barbuda, Costa Rica, Dominica, Grenada, Panama, Saint Lucia and Saint Vincent. Peru, home to approximately 400,000 citizens of Japanese descent, also received several JICA loans and grants in recent years.

Although Japan finance has been evident in the Western Hemisphere for decades, Latin America is unlikely to attract much more Japanese financing through official development channels in the coming years. A recently released white paper suggests that new JICA programs will focus primarily on Africa and Southeast Asia, where Prime Minister Shinzo Abe pledged new aid and investment packages worth $43 billion and $20 billion, respectively, on recent official visits.

Grants and concessional loans coordinated by JICA account for only a small percentage of Japanese finance in Latin America. The majority of government finance to the region is overseen by the Japan Bank for International Cooperation (JBIC), once known as Japan Export-Import Bank. The bank enjoys a broad mandate to promote Japan’s exports, mitigate political risk for companies operating overseas, improve the competitiveness of Japanese firms, and secure strategically important natural resources.

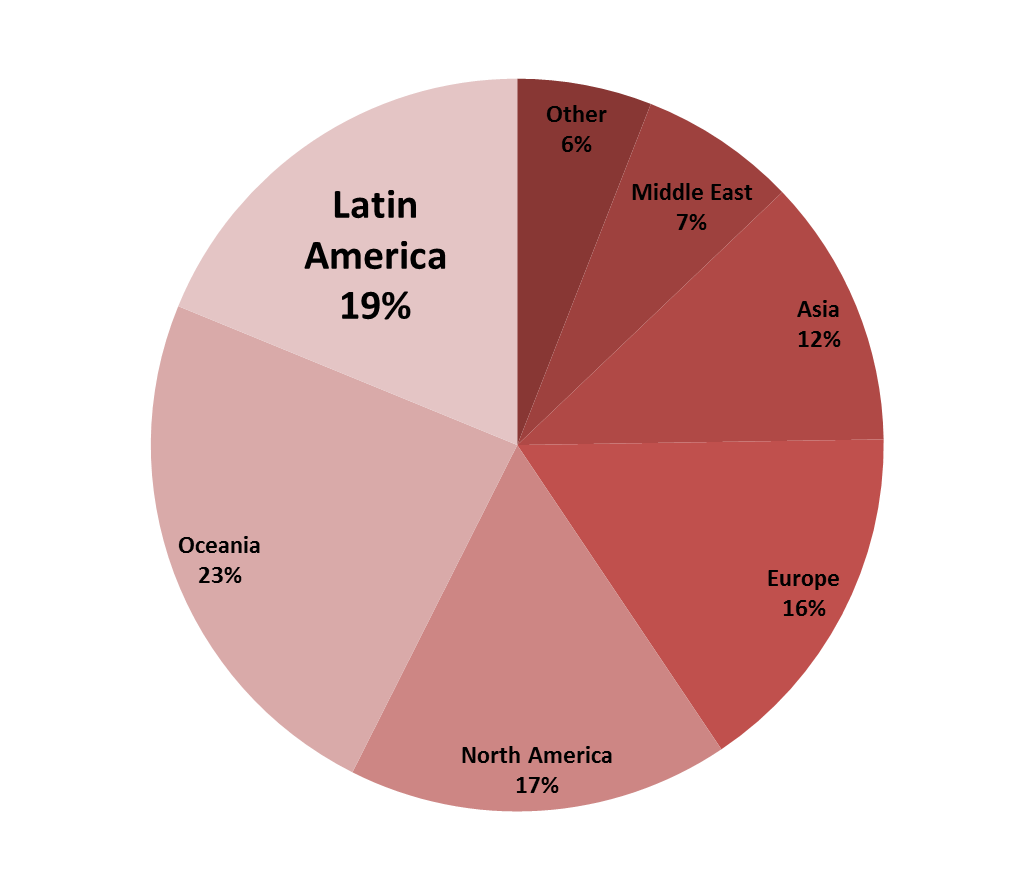

While Japanese ODA to the region is moderate, the scale of JBIC’s operations in Latin America rivals those of major multilateral institutions and Chinese banks. JBIC loans and equity commitments in the region exceeded $10 billion in FY2012, exceeding World Bank support of $6.6 in that year and nearing the $11.4 billion pledged by the Inter-American Development Bank. Latin America has accounted for 20 percent of JBIC’s annual commitments on average since 2008. Although the rapid growth of lending to Latin America by Chinese policy banks has outstripped JBIC’s in recent years, China’s stock of loans in the region is roughly 20 billion less than Japan’s according to the latest available estimates.

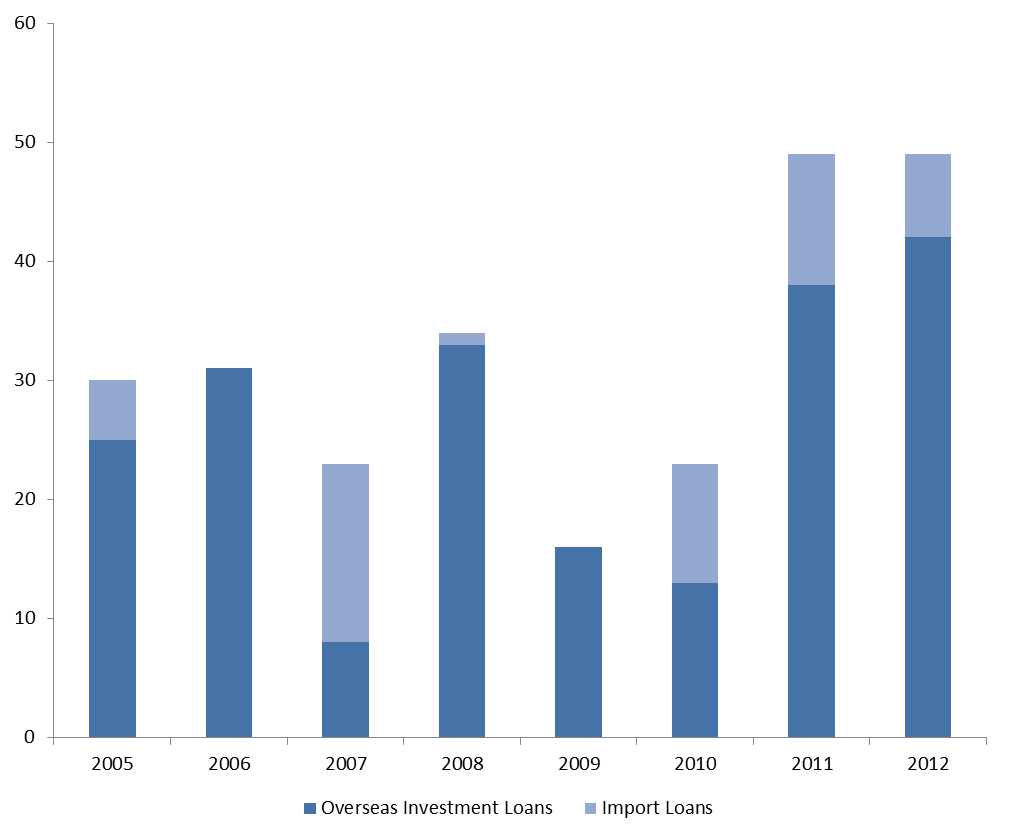

JBIC’s overseas lending practices have changed somewhat in recent years. The percentage of export promotion loans has declined steadily from 74 percent of total overseas financing to just 3 percent, while the share of investment loans grew from 13 percent to 74 percent over the same period. Japan has adopted guidelines for environmental and social considerations by financial firms operating overseas. In their new loans, moreover, both JICA and JBIC have increased their focus on promoting research and development and technology transfer.

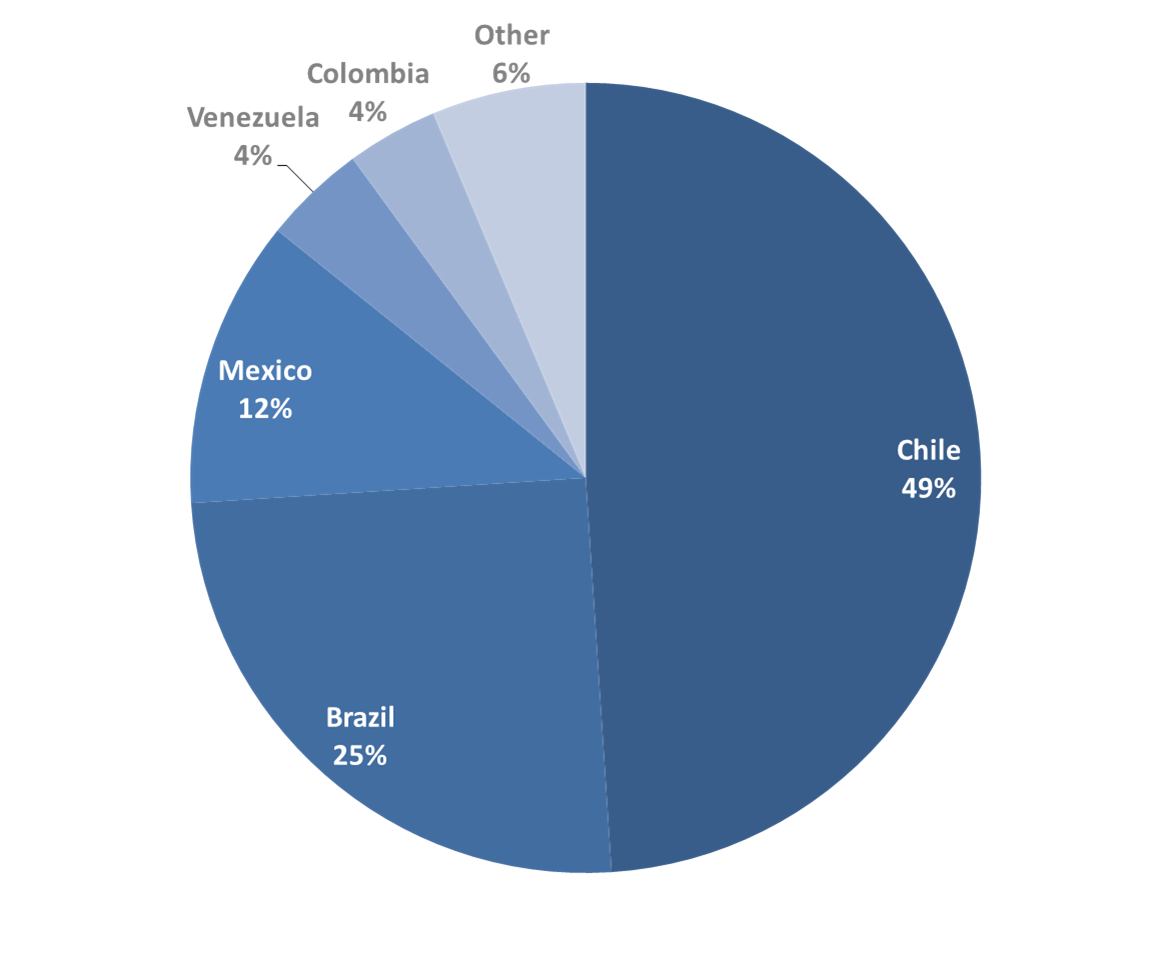

Yet the bank’s portfolio remains highly concentrated in a handful of strategic markets. Brazil, Mexico and Chile together account for more than two thirds of JBIC’s accumulated loans and equity commitments in Latin America. These three countries are Japan’s top trading partners in the region. JBIC has also shown a strong disposition towards governments with market-friendly economic policies. The Pacific Alliance countries – Chile, Colombia, Mexico and Peru – have received a greater share of new loans in recent years, while finance to Argentina and Venezuela has dried up since the mid-2000’s. JBIC has nonetheless indicated interest in funding projects in Ecuador in recent months.

Loans secure critical natural resources and market access

A considerable percentage of JBIC overseas lending supports the acquisition of energy and mineral resources by Japanese firms. Natural resource loans accounted for 49 percent of total JBIC financing in 2012, up more than 20 percent from the average between 2005 and 2010. Billions of dollars in investment and import loans for natural gas, petroleum, copper and iron ore support integration and address supply risks for Japan’s booming high-tech and manufacturing industries.

In Latin America, JBIC works closely with Japan’s horizontally-integrated business conglomerates (keiretsu) to ensure the flow of strategically important minerals to Japanese markets. JBIC will typically co-finance large scale loans with keiretsu-affiliated mega-banks, allowing Japanese firms to establish an equity interest in major mining operations. The resources produced are then supplied to the keiretsu trading arm for export to Japanese consumers.

A string of recent deals in Chile have broadened Japan’s access to copper exports. In 2012, JBIC announced more than a billion dollars in credit to the country’s Caserones and Sierra Gorda copper mines. The bank estimates that these projects will meet 11 percent and 8.5 percent of Japan’s annual copper demand, respectively. More recent deals will provide $420 million for Chile’s Escondida Copper Mine expansion and $479 million for development of the Antucoya Copper Mine. JBIC’s first-ever loan to Bolivia financed the acquisition of additional interest by Sumitomo Corporation in the country’s San Cristóbal mine, estimated to provide between 13 and 14 percent of Japan’s annual demand for zinc, as well as supplies of lead and silver.

JBIC’s activity in the energy sector is also impressive. The bank has signed off on subsequent multi-million dollar agreements to support the development of Brazil’s deep water pre-salt oil reserves in recent years, the most recent in July 2014. JBIC funds will finance new electricity generation projects in Chile and Colombia. Additional equity participation and credit lines have been pledged to improve renewable energy technologies and reduce greenhouse gas emissions in Colombia, Mexico, Brazil and Central America.

Japan’s official loans to Latin America also support manufacturing, which accounted for 34 percent of Japanese foreign direct investment in the region during 2012. JBIC’s role in this area is to promote Japanese exports and reinforce the competitiveness of Japan’s industry in third markets. A series of three JBIC loans totaling $191 million will support the development of automobile production by Japanese firms in Mexico, a key export platform given its free trade agreements with the United States, Canada and other countries in the Western Hemisphere. Credit for steel, glass and metal sheets manufacturing projects in Mexico and Brazil is similarly intended to ensure Japanese market share.

JBIC’s and JICA’s contributions represent only a fraction of aggregate Japanese finance in Latin America – credit from Japan’s private sector has nearly doubled since 2007. By the end of June, Japanese bank claims on Latin American countries exceeded $64 billion (excluding offshore financial centers), compared with the roughly $27 billion in outstanding loans and equity commitments reported by JBIC in its latest annual report. Most overseas loans are issued by one of three Japanese mega-banks: Mitsubishi UFJ Financial Groups, Mitsui Sumitomo Financial Group and Mizuho Financial Group.

The growth of financing to Latin American countries reflects the broader internationalization of Japanese lending since the mid-2000’s. Low demand for credit at home and growing opportunities in emerging markets have prompted Japanese bankers to look abroad in recent years. Japan’s position in global markets was further strengthened by the 2008 financial crisis, which left its banks relatively unscathed. Japan’s three largest financial groups together account for more than 13 percent of global overseas project finance, with Mitsubishi UFJ leading in global market share at 5.6 percent.

The distribution of Japanese private lending mirrors that of JBIC – this is not surprising given that JBIC frequently supports private banks by brokering and co-financing deals overseas. Brazil accounts for over half of total claims outstanding by private Japanese banks, followed by Mexico, Chile, Colombia and Peru. In the coming years, there would appear to be considerable interest in Latin America among Japan’s banks. Japan’s Chamber of Commerce and Industry in Mexico reports that 130 new firms set up shop last year in Mexico alone. Two-thirds of Japanese companies in Latin America surveyed by the Japan External Trade Organization (JETRO) planned to expand their operations in the region over the next 1-2 years.

Japan’s banks have charted an impressive path since the 1960’s, when the country’s firms first began to trade and invest significantly in Latin America. The overall volume of credit has increased significantly over the past several decades and the composition of credit has shifted to encompass a broader mix of lenders. Complex interactions between JBIC, private banks, and Japanese resource, manufacturing and trading companies in Latin America have allowed Japanese firms to establish comprehensive supply networks, access key export markets and establish productive relationships with the region’s governments.

Challenges remain for Japanese banks operating in Latin America – including language and cultural barriers and minimal foreign presence at high levels of Japan’s leading financial institutions. But Japan’s form of engagement has been an example for its neighbors in East Asia. Barbara Stallings, Deborah Brautigam and others have suggested that China’s overseas finance is in many ways informed by Japan’s example. As it seeks to reform the country’s top creditors, China may very well continue to look to Japan.

Colombian firm Interbolsa is being liquidated in a move to protect the interests of Colombia’s financial markets.

What is the state of Peru-China commercial ties today?

China has became a critical economic partner for Venezuela over the past decade.