Brazil’s Challenges and Dilma’s Choices

President Dilma Rousseff, a political neophyte when she was took office in 2011, had a rough first term.

A Daily Publication of The Dialogue

The lower house of Brazil’s Congress on July 10 advanced legislation to overhaul the country’s pension system, with a final vote in the chamber expected in August. Lawmakers estimate that the overhaul could save the government $265 billion over 10 years. Just days later, economists in a central bank survey cut their forecast for the country’s economic growth next year to a new low of 2.10 percent, with anemic growth of 0.81 percent expected this year. Why are expectations for growth ebbing as the pension reform is advancing? What factors are still holding back Brazil’s economy? Which industries will struggle most in coming months, and which will gain strength?

Peter Hakim, member of the Advisor board and president emeritus of the Inter-American Dialogue: “The overwhelming support of pension reform in Brazil’s lower house was a critical victory for both the Bolsonaro government and the nation’s economic prospects. Aside from Dilma Rousseff’s impeachment in 2016, no legislative action has gotten more attention in recent years. This was a must-win for the government. Defeat would have signaled to markets worldwide that Bolsonaro’s plans to revamp the country’s unproductive economic policies were dead in the water and that the recharging of the economy, after a half dozen years of virtually no growth, would again be postponed. Brazilian business leaders along with foreign investors view pension overhaul as a bellwether of the country’s economic future. Although three additional congressional votes are needed for this constitutional change, it is widely anticipated that final approval is just a matter of time and that the broader economic reforms essential for stable, long-run growth are now within reach. The immediate reaction to the legislative victory was a jump in the value of the Brazilian real and a new high for the stock exchange. Still, expectations should be held in check. Brazil’s mediocre economic performance for much of the last three decades is reason enough for skepticism. The Brazilian Congress, despite its solid backing of the pension legislation, is an erratic institution that could readily change direction. Public reactions to the loss of anticipated retirement benefits remain uncertain. The reform effort could also be upended by the Bolsonaro government’s fading support, mostly reflecting the country’s sluggish economy and elevated unemployment, but also driven by unpopular policies, offensive statements, questionable choices of senior officials and a few scandals. Nonetheless, the opening legislative success for pension reform should be welcomed, even by those strongly opposed to Bolsonaro and most of his agenda for Brazil.”

Joel Korn, president of WKI Brasil and senior international partner at UPITE Consulting Services: “The imminent approval of legislation for a new pension system is indeed a milestone in the country’s economic agenda and of foremost importance for the critically needed fiscal adjustment. It is a meaningful step toward a much-awaited economic turnaround and an overall improvement of confidence, strengthening expectations for a moderate recovery in the months ahead. However, the carryover effect of a very weak first half—actually, a contraction in the first quarter—makes it inevitable to project another year of mediocre GDP growth in 2019, below 1 percent. Assuming congressional approval within the next six months of the equally important and challenging tax reform, along with the implementation of privatization programs and microeconomic/deregulation measures targeting enhanced productivity and competitiveness, it is reasonable to expect that a surge in investment and consumer demand will be the driving factors for stronger economic growth in 2020, within the range of 2 percent to 2.3 percent. Overdue infrastructure projects, along with oil and gas exploration and production activities, should lead to renewed impetus in heavy construction and extraction sectors, enabling a gradual and positive impact on new jobs and a lower unemployment level. Moreover, stronger domestic demand for industrial and consumer products will play an important role in the much-needed recovery of the manufacturing sector. The planned sound liberalization policies along with specific actions oriented to reduce the ‘Brazil cost’ should go a long way in restoring investor and consumer confidence, paving the way for a renewed investment cycle, strengthening of export capacity while shifting the country away from an excessively protected and domestic-oriented economy to become an active player within the contemplated new foreign trade agreements and alliances.”

Gary Hufbauer, senior fellow at the Peterson Institute for International Economics: “The stock market welcomes Brazil’s progress toward pension reform: EWZ, an exchange-traded fund that tracks the market, is up about 20 percent in dollar terms since the legislation got underway in late May. The prospect of slow GDP growth doesn’t bother investors because they hope for continued low inflation (now under 4 percent) and relaxation of Brazilian interest rates (still above 6 percent). But slow GDP growth—not much better than 2 percent in 2020—can’t be good for Brazilian households. What’s the problem? A highly protected economy, with average tariffs above 13 percent, coupled with all sorts of regulation that puts Brazil well behind China, Chile and Mexico in the World Bank’s Doing Business report. Brazil is a country where Joseph Schumpeter is taking a long nap, creative destruction and productivity growth are almost non-existent, and local monopolies flourish. Pension reform, while essential, at best offers a small start toward eradicating fundamental obstacles to growth.”

The Latin America Advisor features Q&A with leaders in politics, economics, and finance every business day. The publication is available to members of the Dialogue’s Corporate Program and others by subscription.

President Dilma Rousseff, a political neophyte when she was took office in 2011, had a rough first term.

Next year, critical elections in Latin America’s three most populous countries—Colombia, Mexico and Brazil—are likely to reveal a distemper stemming from citizen disgust with a mix of corruption scandals, mediocre economies, unremitting violence and a largely discredited political class. All three presidential contests are wide open and ripe for anti-establishment challengers.

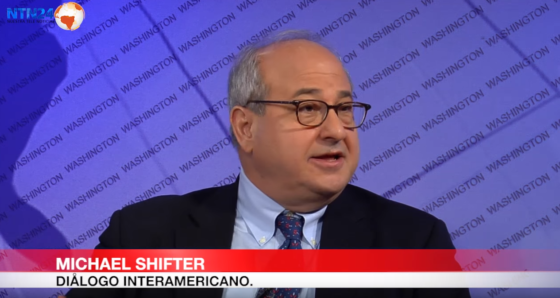

En este programa especial de Club de Prensa, Michael Shifter conversa sobre lo que esperar en 2018 – un año clave para el destino de América Latina.

Brazilian President Jair Bolsonaro is seeing his landmark pension reform advance, but the country is still mired in sluggish growth. // File Photo: Brazilian Government.

Brazilian President Jair Bolsonaro is seeing his landmark pension reform advance, but the country is still mired in sluggish growth. // File Photo: Brazilian Government.

Video

Video