Rising Brazil: The Choices Of A New Global Power

What should we expect from a newly powerful Brazil? Does the country have the capacity and leadership to be a central actor in addressing critical global and regional problems?

A Daily Publication of The Dialogue

Over the past year, major economic headlines in Latin America included a currency crisis in Argentina, continued deterioration and hyperinflation in Venezuela and the beginnings of Brazil’s emergence from its worst recession on record. What does 2019 hold in store for Latin American economies? Which countries will perform well economically, and which will struggle, and why? What are the main domestic factors, and the main external factors, that will affect the region’s economies in the coming year?

Richard Francis, director of Latin American sovereigns at Fitch Ratings: “Fitch expects regional GDP, excluding Venezuela, to growth by 2.1 percent in 2019 from an estimated 1.5 percent in 2018. However, downsize risks persist from the external backdrop with tightening global financing conditions, increased trade tensions, economic slowdown in China, and a possible sharper fall in commodity prices. We expect Argentina, Nicaragua and Venezuela to remain in recession next year. Economic growth could slow in Ecuador, as well. However, Fitch expects some moderate acceleration in many of the key economies in the region, including Brazil, Colombia and Peru. Despite the improved prospects for the region overall and many of the key economies in the region, Fitch expects most economies to continue to grow below their potential. Sovereign ratings pressures continue to build for the region as well. Fitch currently has six negative outlooks for ratings in Latin America and the Caribbean and only one positive outlook. 2019 looks to be another challenging year for the region overall. Elections in Argentina, Uruguay and El Salvador will prove pivotal for each of the next administration’s policy orientation as well as their ratings trajectory (both Argentina and Uruguay have negative outlooks). Additionally, there will be new governments in the two largest countries in the region, Mexico and Brazil. In Mexico policy uncertainty has increased, while in Brazil a market-friendly agenda has lifted investor sentiment, but a fragmented Congress could block passage of difficult reforms.”

Joydeep Mukherji, managing director of Latin American Sovereign Ratings at Standard & Poor’s in New York: “Decelerating world GDP growth, rising U.S. interest rates and concerns about new barriers to cross-border trade will set the background for economic trends in Latin America in 2019. The world economy is projected to grow around 3.7 percent in 2019, similar to its pace in 2018. Emerging market economies are likely to grow just under 5 percent, more than double the pace of growth in advanced economies (around 2.1 percent). The Latin America and Caribbean region (excluding Venezuela) is likely to grow only 2.2 percent in 2019, slower once again than emerging Asia and Sub-Saharan Africa. Panama is likely to be the fastest growing country in the region, expanding around 5 percent, likely followed by Peru at just below 4 percent. We expect that Venezuela and

Argentina are likely to again be in recession in 2019. The modest pace of economic expansion in much of Latin America largely reflects structural weaknesses, especially poor productivity. In general, the region continues to have low private and public sector investment. For example, investment in infrastructure has been around 2 percent of GDP in Brazil, and slightly lower in Mexico, compared with just below 5 percent in faster-growing India and over 8 percent in China. Poor infrastructure, along with shortcomings in the education system, contribute to low productivity and weak external competitiveness. As a result, too much GDP growth in Latin America depends on public sector spending and the non-tradable sector of the economy. In contrast, private sector spending (including for investment) and the tradable sector of the economy play a comparatively bigger role in driving GDP growth in many Asian countries.”

Alfredo Coutiño, director for Latin America at Moody’s Analytics: “After an unexpected economic moderation in 2018, Latin America will report some economic improvement in 2019. Recovery in investment, together with improvement in the terms of trade, will be the drivers of growth. The incipient recovery that started in 2017 was interrupted in 2018, with the region’s economy dragged down by the prolonged recession in Venezuela and the contraction in Argentina. In 2019, the region will gain some momentum, benefiting from a more general improvement, with growth trending up along the year. The expansion will be driven by further advances in Brazil, Colombia, Peru and Uruguay, followed by a normalization in Chile. Mexico will report moderation due mainly to the typical economic deceleration in the first year of a new government. Argentina and Venezuela are expected to report less negative rates. The region’s performance will be led by South America, followed by Central America which is highly dependent on the U.S. market. Further advance in structural reforms in Chile, Brazil, Peru and Colombia, countries ruled by more pro-market governments, will give a push to fixed investment and production capacity. Mexico and Venezuela will be the only two countries where the investment ratio will adjust downward in 2019. Hence, Latin America will advance toward growth of 1.4 percent in 2019, almost twice the 0.8 percent reported in 2018. External risks lie in a potential trade war between the United States and China, higher U.S. interest rates, fears of recession in the United States with a deeper correction in stocks and a fall in commodity prices. On the domestic front, Brazil’s challenge is to quickly correct the fiscal imbalance and keep the economy growing. Mexico’s risk is the uncertainty and doubts about the way the new government will run politics and economics given its strong populist bent.”

Marcos Casarin, head of Latin American macro services at Oxford Economics in London: “Our expectation that Latin America’s GDP growth will nearly double to 1.7 percent in 2019 is based on the recovery in Brazil, which should grow faster than 2 percent for the first time since 2013. But it’s not all good news. We expect Ecuador and Costa Rica to face fiscal challenges, Chile to suffer another sovereign rating downgrade and Mexico to keep a very tight monetary stance, despite feeble growth as risk premiums on Mexican assets remain elevated; this will leave Mexico with relatively high real interest rates. We also expect Brazil to grow faster than Mexico for the first time since 2013, as Bolsonaro’s government passes a pension reform, further boosting the positive momentum in Latin America’s largest economy. Perhaps surprisingly, we expect Argentina to stay on track with its IMF program and Venezuela to keep making payments on the PDVSA 2020 bond in a bid to avoid losing Citgo.”

The Latin America Advisor features Q&A with leaders in politics, economics, and finance every business day. The publication is available to members of the Dialogue's Corporate Program and others by subscription.

What should we expect from a newly powerful Brazil? Does the country have the capacity and leadership to be a central actor in addressing critical global and regional problems?

President Lula da Silva triumphantly announced that he and his Turkish counterpart had persuaded Iran to shift a major part of its uranium enrichment program overseas—an objective that had previously eluded the US and other world powers. Washington, however, was not applauding.

Hugo Chavez, the Venezuelan president, has clearly been enticed by the Libyan drama, where his longtime friend and ally, Muammar al-Qaddafi, is under siege from rebel forces.

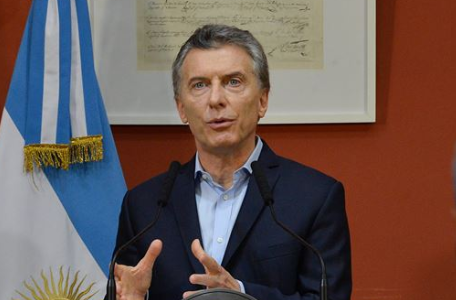

Argentina, where President Mauricio Macri’s government faced a currency crisis last year,

is likely to remain in recession, Richard Francis of Fitch Ratings says below. // File Photo:

Argentine Government.

Argentina, where President Mauricio Macri’s government faced a currency crisis last year,

is likely to remain in recession, Richard Francis of Fitch Ratings says below. // File Photo:

Argentine Government.