The Politics Of Disaster Relief

After a 7.0 magnitude earthquake struck Haiti, the aftershock reached China in ways that few anticipated.The earthquake forced Chinese leaders to navigate the tricky politics of disaster relief.

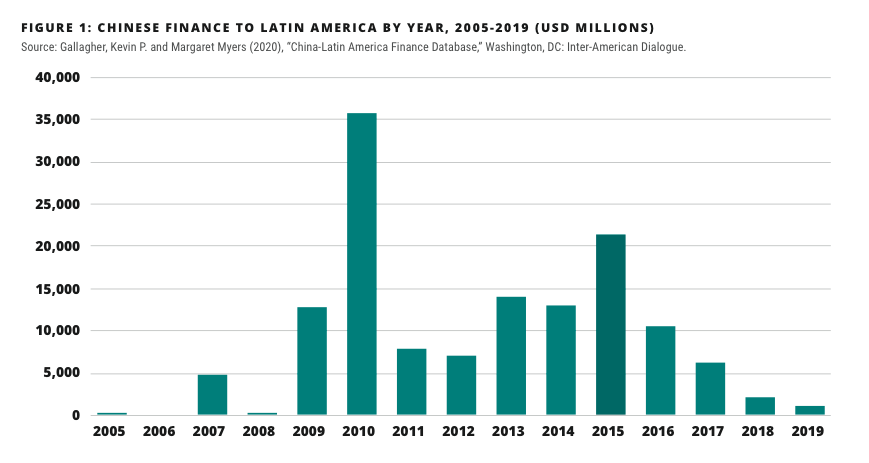

The Inter-American Dialogue's Asia & Latin America program and the Global China Initiative at Boston University’s Global Development Policy Center (GDP) estimate that China's policy banks, China Development Bank and China Eximbank, issued roughly $1.1 billion in loans to LAC governments and state-owned firms in 2019. See the newly-updated Dialogue-GDP China-Latin America Finance Database and our report, Scaling Back: Chinese Development Finance in LAC, 2019, for details on last year's and previous loan agreements.

Chinese state finance to LAC still differs in important ways from loans issued by traditional development finance institutions. CDB and Eximbank loans continue to focus on hard infrastructure and energy sector development. Chinese loans also refrain from imposing policy conditions on recipients but continue to promote the use of Chinese companies and/or equipment.

Even if Chinese policy banks continue to lend to LAC at low levels, as they have over the past three years, the combined effect of Chinese policy bank activity, co-financing initiatives, commercial bank finance, and other forms of lending will ensure a sizable Chinese financial presence in the region for years to come, potentially in a wider variety of projects. But total combined Chinese finance to the region is unlikely to ever approximate policy bank peak lending.

After a 7.0 magnitude earthquake struck Haiti, the aftershock reached China in ways that few anticipated.The earthquake forced Chinese leaders to navigate the tricky politics of disaster relief.

Hugo Chavez, the Venezuelan president, has clearly been enticed by the Libyan drama, where his longtime friend and ally, Muammar al-Qaddafi, is under siege from rebel forces.

Estimates of the volume, composition, and characteristics of Chinese lending to the region since 2005.