Congressional Testimony: Examining De-Risking and its Effect on Access to Financial Services

US House of Representatives

US House of Representatives

CONGRESSIONAL TESTIMONY AS SUBMITTED FOR RECORD AND DELIVERED BEFORE THE SUBCOMMITTEE ON FINANCIAL INSTITUTIONS AND CONSUMER CREDIT OF THE HOUSE OF REPRESENTATIVES' FINANCIAL SERVICES COMMITTEE.

“De-risking,” as defined by the subcommittee, occurs when a financial institution terminates relationships and closes the accounts of clients and merchants they deem “high risk” in order to avoid legal liability and greater regulatory scrutiny. This practice has negative consequences for many legitimate money services businesses, including money transfer businesses, and their consumers.

My testimony today discusses the ongoing effects of de-risking and addresses regulatory opportunities for Congress and the Administration to ensure the United States provides equal access to financial services to all legitimate businesses. This testimony is submitted before the Subcommittee on Financial Institutions and Consumer Credit at the hearing entitled "Examining De-risking and its Effect on Access to Financial Services" on Thursday, February 15, 2018.

The systematic termination of bank accounts for non-banking financial institutions is affecting small businesses and financial services worldwide. This problem has existed in some form over the past 20 years but has grown more pronounced following the global 2009 recession. This testimony provides input on a current problem affecting access to financial services. It analyzes the trends, provides information on the causes, and presents some of the impacts as identified in my research. I will conclude by discussing solutions and recommendations.

Understanding the Causes of De-Risking

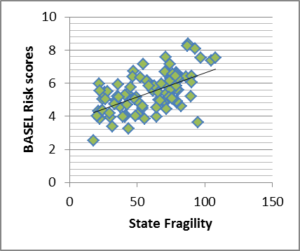

This systematic pattern of account termination is not directly related with increased financial crimes or with an increased level of risk. Financial crimes typically include fraud and money laundering related to organized crime. In 2012, the Basel AML risk index reported that on a scale of 1-10, only five countries scored 8 or more, indicating high risk levels. In 2017, there were only 6 countries on the high-risk list. Other reports have shown similar trends, where risk levels remain unchanged or have even decreased in recent years.

Account closures are not directly linked with increases in financial risk. Rather, the pattern of account closures coincides with the exponential growth in consumer use of nonbanking financial services (NBFIs), which occurred in the early 2000s. For example, between 2004 and 2011 deposit accounts per 1,000 adults increased 15% and 7.6% for low and low-middle income countries, respectively. In places like Mexico or Guatemala, for example, there is an increase in access to financial institutions from 20% to 40% over that period.

Similarly, CGAP reported that between 2004 and 2011 there has been an increase in the presence of non-banking financial institutions providing financial services to people, while at the same time banking institutions decline. In fact, looking at Latin America and the Caribbean, financial payment points for remittances increased between 2000 and 2017. Using Mexico and Guatemala as examples, in 2009 the number of payment points (including bank branches, non-banking financial institutions branches/agents, and retail stores) amounted to 25,000 and 3,000 for these two countries. In 2016, the number had dramatically grown to 240,000 and 130,000, respectively. Meanwhile, the bank share of these payment points relative to all locations dropped from 70% to 50%. Further analysis shows that this is due to an increase in nonbanking financial institutions (NBFIs) performing financial transactions and a decline in bank branches.

The consequences of closing bank accounts, after the surge in financial services handled by non-banks, are significant. Important examples can be found in the remittance industry, and in the termination of corresponding banking relationships in the Caribbean.

Impacts of De-Risking on the Remittance Industry

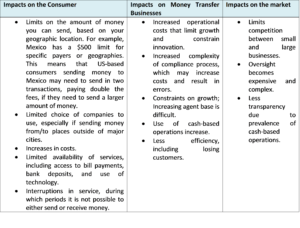

Remittance companies, also known as money service businesses, have experienced systematic account closures that have accelerated in the past few years. An Inter-American Dialogue survey of the major remittance companies in the industry shows that in the early 2000s these companies experienced one or two account closures each year. However, from 2010 on, businesses experienced at least four account closures per year. In turn, these companies have been operating with only three bank accounts on average to perform business in at least 30 states. The following table illustrates some of the impacts of de-risking on remittances, taking into consideration impacts on consumers, on businesses, and on the market.

Table 1: Impacts of Bank Account Closures for the Remittance Industry

Source: Orozco, Porras and Yansura, “Bank Account Closures: Current Trends and Implications for Family Remittances,” Inter-American Dialogue, December 2015.

Source: Orozco, Porras and Yansura, “Bank Account Closures: Current Trends and Implications for Family Remittances,” Inter-American Dialogue, December 2015.

As banking institutions, and global banks in particular, increasingly handle money indirectly through non-banking financial institutions or the corresponding banking entities servicing these NBFIs, many banks deemed and perceived the handling of third party funds from these institutions a financial risk. The reasons given have not been entirely clear.

Impacts of De-Risking in the Caribbean

Though de-risking is a global issue, the Caribbean has been particularly hard hit. In the Caribbean, de-risking has manifested itself in several ways: first, by damage to correspondent banking relationships, and second, by disruptions in remittance flows occurring as a result of bank account closures or correspondent banking interruptions.

Many commercial banks in the Caribbean saw longstanding banking relationships terminated due to the perception that financial activity with the Caribbean is by definition high-risk. Rather than manage risk or assess banking partners on an individual basis, a blanket assessment is made and banking relationships are terminated. The International Monetary Fund notes that while correspondent banking issues are occurring in many financial corridors, “the Caribbean is identified as the most severely affected.” A survey conducted by the Caribbean Association of Banks shows banks in 12 Caribbean countries have experienced a loss of correspondent banking, including the Bahamas, Belize, Guyana, Jamaica, Suriname, Trinidad and Tobago and countries in the Eastern Caribbean Currency Union.

Moreover, bank account closures also disrupted the flow of remittances at a regional level. “The sudden closure of money-transfer services in the Cayman Islands threatens to render thousands of people here, and thousands more of their family members across the world, in immediate and intractable financial straits,” a local newspaper reported in July of 2015. In addition to its very significant human impact, the disruptions may have caused reputational damage to a country whose “status as an international financial center is predicated upon the mobility and fungibility of currency.”

The impacts have been harmful because it is a region that is economically dependent on external trade, tourism, remittances, and offshore banking. All of these economic areas require the rapid, efficient, and secure movement of funds as well as the conversion of currencies. When the ability to move funds is hindered, there are two possible outcomes: first, business is interrupted with negative economic impacts, or second, business goes on but through informal channels that do not meet international AML/CFT standards. Both options are unacceptable, and action is needed to address the de-risking issue at its core.

Some Possible Solutions

Whatever the causes, is important that financial institutions shift their approach from de-risking to financial risk prevention. Solutions should include improving confidence among institutions about measures on due diligence, as well as improving knowledge and clarity regarding the source of financial threats. Specifically, there are three main issues that merit attention:

- There is a lack of accountability when it comes to discretionary decisions to terminate bank accounts. Decisions are neither justified nor are they backed with evidence.

- The relationship between the regions where systematic account closures are occurring do not clearly align with regions of AML/CFT risk

- Increases in financial services coincide with increases in accounts closed, which in turn may discourage financial access.

Because the problem continues to affect many countries (especially those that are more dependent on external financial systems) is essential to address short-term solutions. These include:

a) The United States Congress and Treasury should rule on increased transparency between banks and MSBs, and between banks and corresponding banks. This should include internal oversight within banks about their procedures to manage MSB accounts, documenting reasons for account closures and allowing for a right to appeal the decision. The Spanish experience may offer an insight on how to address transparency.

Account closures are significantly discretionary actions. It is not a healthy process because it lacks transparency and accountability. Changes need to be made so that the process includes an exchange of information, supporting documentation, and communication between the bank and MSBs. For example, it is important that banks notify the MSB of suspected irregularity, identify the perceived or suspected activity or transaction, and request explanations within specific compliance standards. MSBs should also be able to exercise the right of rebuttal, as a last recourse. The recent experience in Spain is an important reference for this recommendation.

b) Improve and share country and industry risk assessment evaluations to narrow any error relating to assumptions of third-party liability.

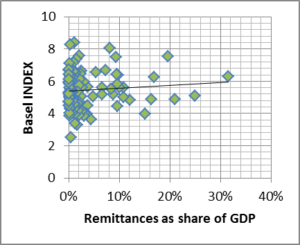

The existing data on country and industry risk is not systematic, nor shared among all players. Moreover, the assessment of risk does not always coincide with the account closures. Although remittance companies are considered able to manage risk with their existing prevention mechanisms and are in line with US government regulations, they are still presumed to be high risk. In fact, while there is a strong correlation between AML risk and fragile states, the same is not the case with AML risk and remittance recipient countries where these companies operate. Better data collection is needed to corroborate patterns of perceived risk.

BASEL Risk Scores and State Fragility BASEL Index and Remittances as Share of GDP

Source: Data compiled by the author based on various sources, including the Index on State Fragility, the World Bank data on remittances and the Basel AML risk index.

c) Establish a risk-based clearing house among banks, MSBs, and governments that observes trends and identifies red flags.

The wealth of knowledge and expertise accumulated by MSBs is not negligible when it comes to preventing financial crimes. Companies’ screening systems can detect a suspicious activity and prevent crime. As they reach out further down the marketplace to consumers, they can be an important first line of defense against financial crimes. Their knowledge could be shared through systematized data along clearing houses that disseminate and share the data, provide assessments and flag suspicious consumers, agents and locations.

d) Expand the scope of permitted reliance under the Money Transfer Improvements Act of 2014 (H.R. 4386; Pub.L. 113–156) to allow financial institutions to rely on state reports that are provided to them (the states would have to agree to release the reports on a case by case basis). The Act currently authorizes the US Treasury to rely on examinations conducted by state supervisory agencies. Allowing banking institutions to study and use those examinations will serve as a confidence building mechanism, and a reference to work with a money service business.

e) Include bank MSB services in bank examiners’ review of Community Reinvestment Act (CRA)’s rating relating to the “Way in which services are provided throughout the assessment area for the convenience and needs of customers.” The CRA is an important instrument that can serve as a criterion to determine whether banks are fully serving communities. One important contribution of the CRA was the inclusion of international remittance services as well as providing financial services to customers. It is important for bank examiners to review the extent to which account terminations may lead to a loss of financial services in the community.