China’s Strategy in Brazil & the Southern Cone

What does China stand to gain from investing in Latin America’s energy projects? Where is China looking next in the region?

What does China stand to gain from investing in Latin America’s energy projects? Where is China looking next in the region?

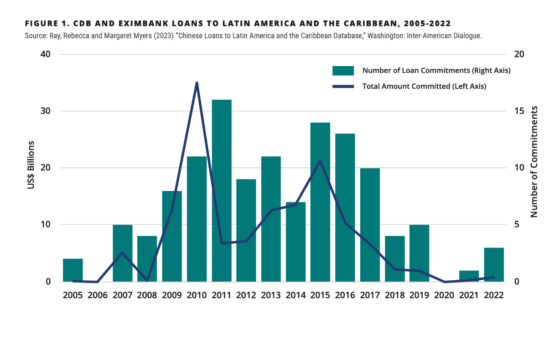

Despite slowing growth on both sides of the Pacific, China’s policy bank finance to Latin America reached $30 billion in 2015.

The year 2016 was the third highest on record for Chinese state-to-state finance in Latin America.

Estimates of the volume, composition, and characteristics of Chinese lending to the region since 2005.

China’s economic footprint in the region is expanding at a rapid pace. Can Latin American societies keep up?

On May 24, the Inter-American Dialogue and the Boston University Global Development Policy Center co-hosted a webinar titled “At a Crossroads: China’s Post-Pandemic Economic Relations with Latin America and the Caribbean.” The event considered China’s dynamic and evolving economic engagement with the Latin America and the Caribbean (LAC) region, and drew upon new findings and data from the Inter-American Dialogue and the Boston University Global Development Policy Center.

El 14 de abril, Margaret Myers, directora del Programa de Asia y América Latina del Diálogo Interamericano, habló con Voz de America sobre tendencias en la relación entre China y América Latina.

On April 16, Margaret Myers, director of the Asia and Latin America Program at the Inter-American Dialogue spoke with Ada Derana English about new trends in Chinese overseas economic engagement.

On March 31, Foreign Policy cited the newly-released Inter-American Dialogue’s and Boston University Global Development Policy Center report on 2022 Chinese finance to LAC.

Margaret Myers wrote for the Woodrow Wilson Center’s Weekly Asado on Chinese companies’ continued investment in energy generation and transmission in the LAC region.

In the newest episode of The China-Global South Project Podcast, Margaret Myers, director of the Asia and Latin America Program at the Inter-American Dialogue, considered new trends in Chinese economic engagement with the LAC region.

Margaret Myers and Rebecca Ray wrote for The China Global South Project on Chinese Finance to LAC in 2022.

China’s development finance institutions demonstrated renewed interest in lending to LAC in 2022, issuing US$813 million in loans to three LAC governments or state institutions.

Augusto de la Torre analyzes the Ecuador-China agreement to restructure $4.4 billion of Ecuador’s debt with Chinese banks.

Again this year, China’s policy banks—China Development Bank (CDB) and the Export-Import Bank of China (Eximbank)—issued no new finance to Latin American and Caribbean (LAC) governments or state-run companies, according to findings from the Inter-American Dialogue’s Asia and Latin America Program and the Boston University Global Development Policy Center (GDP).

Video

Video

Video

Video

Video

Video