China’s Rising Investment Profile in the Caribbean

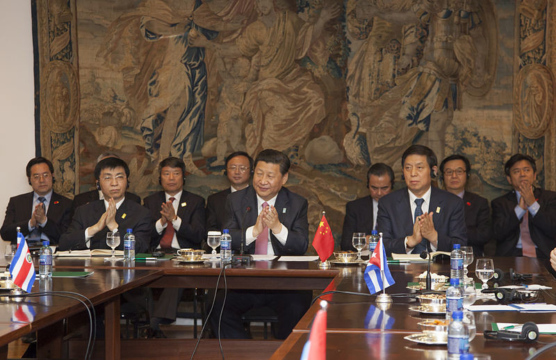

Chinese companies have initiated ventures in more than a dozen Caribbean countries.

China’s proposals for economic reform and its commitment to deeper economic integration with Latin American nations will change the landscape of China-Latin America economic engagement in coming years. Latin American nations, meanwhile, have adopted strikingly different approaches to managing China’s expanding economic influence in the region. The Dialogue’s China and Latin America economics briefs highlight areas of emerging interest at a pivotal moment in China-Latin America economic relations.

Addressing these issues, Inter-American Dialogue is pleased to publish (see below) this economic brief prepared by Jahangir Aziz, current Senior Asia Economist for JP Morgan Chase as well as former Principal Economic Advisor to India’s Ministry of Finance and former head of the IMF’s China Division. An expert on Asian models of economic growth, Aziz has written extensively on China’s banking sector reforms and financial sector development. In this paper, the third in a series of economics briefs published by the Inter-American Dialogue’s China and Latin America Program, Aziz examines Latin America’s role in China’s renminbi (RMB) internationalization process. He foresees low demand among Latin American nations for RMB-denominated transactions in coming years.

Our first and second briefs assessed China’s free trade agreements in South America and trends in Latin America’s commodity sectors. Future contributors will address such topics as the China Development Bank policies, urbanization trends in China and Latin America, and China’s growing influence on Latin American industrial policy. We are pleased to recognize Open Society Foundations for its assistance in publishing this and forthcoming China and Latin America economics briefs.

Chinese companies have initiated ventures in more than a dozen Caribbean countries.

China is an increasingly important economic partner for Latin America.

Miguel Otero-Iglesias and Agustin Gonzalez-Agote discuss China’s currency internationalization ambitions in this guest blog post for the Inter-American Dialogue’s Asia and Latin America Program.